This is a thorough examination of HSB Securities & Equities Ltd, where you will learn everything about its offerings, trading platforms, exposures, etc. This is a comprehensive review of HSB Securities & Equities by tradingcritique.com. Before investing in HSB read this article and then decide about using this platform to trade.

HSB Securities & Equities Ltd Broker Review- An Intro

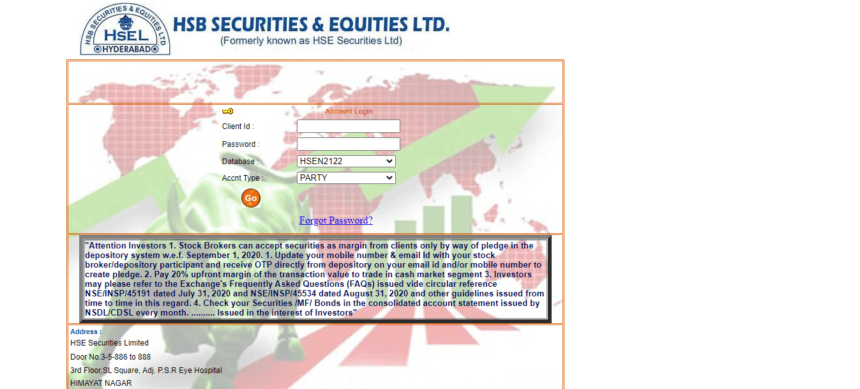

In India, HSB Securities & Equities Ltd is a full-service brokerage firm and HSE Securities Ltd was the company’s previous name. Let us take a closer look at HSB Securities and gain a better knowledge of its Demat Account, brokerage costs, platforms, and other key aspects.

Regulation: SEBI (The Securities and Exchange Board of India)

Account Types: Demat and Trading account

Demo Account: NO

Islamic Account: NO

Market Instruments: Equity, Commodity, Currency, Options, Futures

Trading platforms: Web Trading, Mobile Trading

Maximum Leverage: 6X

Customer Support: 24/5

Regulations & Trust ability Review of HSB Securities & Equities Ltd Broker

HSB Securities is a privately held trading firm. It was created in 1999 by V. R. Bhaskar Reddy and is headquartered in Hyderabad, Andhra Pradesh. It is a SEBI-registered broker that has been in the stock trading business for a long time. It is a member of the MSEI, NCDEX, NSE, BSE, MCX-SX, and MCX.

The securities are deposited with either the National Securities Depository Limited (NSDL) or the Central Depository Services Limited (CDSL). Both the CDSL and the NSDL are depositories recognized by the Indian government to retain assets such as stocks, commodities, bonds, and ETFs in electronic or physical form, and various brokers employ one of the two depository types.

Table 1: HSB Securities & Equities Ltd Membership details

| Membership | |

|---|---|

| Corporate Identification Number (CIN) | U67120TG1999PLC032788 |

Financial Assets Review of HSB Securities & Equities Ltd Broker

This brokerage firm offers its clients a variety of trading and investment products. Other investment

products need,

Trading Assets of HSB Securities & Equities Ltd

Trading platforms Review of HSB Securities & Equities Ltd Broker

The following aspects of trading platforms must be considered while developing trading applications:

Performance, design, user experience, usability, integrations, and so on.

Trading platforms of HSB Securities & Equities Ltd

Web Trading platform

Clients receive the most recent news, market information, and research reports, which may be utilized to trade upon several exchanges on this Web Trading platform. The portal also provides live order and trade status, an online back office to manage investments, online IPO and mutual funds, and online money transfers via numerous banks.

Mobile Trading platform

This Mobile Trading provides important function shortcuts for faster trading. On a single screen, you may access many exchanges, segments, and products, as well as real-time quotes and rates and dynamic charting including indicators.

HSB Securities Knowledge bites

In 1999, V. R. Bhaskar Reddy established HSB Securities. In general, full-service brokers provide their clients with additional investing advice and do in-depth stock research. Brokerage commissions are likewise on the expensive side. The registration state of HSB is Telangana. It has a paid-up capital of 116783380.00 and an authorised share capital of 120000000.00.

Review on Types of Account of HSB Securities & Equities Ltd Broker

It is simple to open the HSB Securities trading account and Demat account. When you create a Demat account, you must pay specific fees such as account maintenance fees, broker commissions, GST, and STT.

Trading Accounts of HSB Securities & Equities Ltd:

Trading account

Demat account

Fees & Commissions Review of HSB Securities & Equities Ltd Broker

An investor may also be charged for using the broker’s various services. Other transaction charges, such as SEBI Turnover, Stamp Duty, and GST, which are incurred on commercial transactions, are not included in the Brokerage Charges. However, these relatively minimal fees have no impact on your earnings or investment return. A margin deposit of at least Rs.1, 000 is required for a trader to launch a securitized trading position.

Table 2: Fees and commissions of HSB Securities & Equities Ltd

| HSB Brokerage Charges | |

|---|---|

| Currency Options | Rs.10 per Lot |

| Currency Futures | 0.02% |

| Equity Options | 0.02% |

| Equity Futures | 0.02% |

| Equity Intraday | 0.02% |

| Equity Delivery | 0.15% |

| Commodity Options | 0.02% |

| HSB Account Opening Charges | |

| Account Opening Charges | Rs.229 |

| Trading AMC | Free |

| Demat AMC | Rs.259 per Annum |

| HSB Other Charges | |

| SEBI Turnover Charges | 0.0002% of Total Turnover |

| Transaction Charges | 0.00317% |

| GST | 18% of (Brokerage + Transaction Charges) |

| STT | 0.0126% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

Leverage Review of HSB Securities & Equities Ltd Broker

HSB securities provide clients with up to 6-x leverage. They provide Intraday and Option traders with a lot of exposure. In comparison to other brokers, they provide relatively little trading exposure.

Table 3: Maximum Leverage of Assets available in HSB Securities & Equities Ltd

| HSB Assets | HSB Maximum Leverage |

|---|---|

| Equity Options | Up to 6X |

| Equity Futures | Up to 1X |

| Equity Intraday | Up to 6X |

| Equity Delivery | Up to 3X |

| Currency Options | Up to 1X |

| Currency Futures | Up to 2X |

| Commodities | Up to 2X |

Bonus & Offers of HSB Securities & Equities Ltd Broker – A Review

The HSB Securities provides the list of Broking Offers. They offer a free trading account setup. A Demat Account is charged a fee. There are broker discounts available. They feature a few interesting promotions, such as Holiday offers and Referral Offers.

Research & Education Review of HSB Securities & Equities Ltd Broker

A research report or trading news is vital for traders since it assists them in making trading decisions. Their connection team assists their traders. Every section receives free stock suggestions for intraday and holding trading. Traders are given a personal offline recommendation from the broker. They fail to give important information such as technical suggestions, top picks, IPO reports, and so forth.

Rewards & Risk Review of HSB Securities & Equities Ltd Broker

Pros Pros |  Cons Cons |

|---|---|

| The brokerage firm offers a variety of incentives, such as a free trading account, a referral program, holiday deals, and more. | It doesn’t support 24/7 |

| They have an online account opening process. | It does not provide chat support or a toll-free number. |

| The company offers a variety of products and services to their customers. | The improvement of customer service is necessary to respond to client inquiries. |

| It also provides Mobile & Web trading platforms. | It is not feasible to invest directly in IPOs. |

| Problems with their trading systems must be resolved. | |

| Do not provide any kind of counsel, guidance, research reports, or anything else. |

Customer Support Review of HSB Securities & Equities Ltd Broker

HSB has nearly 12 branches around the country, so anyone may go to any of them for a rapid response. You could also write an email to the client services email address for assistance. Customers that have full access to customer service can contact the broker via the media at any moment to get a resolution to their issue.

A specialized relationship manager is accessible for all sorts of financial investment recommendations. On-site training will be provided for you and your staff to use the various trade platforms, back – office systems, and to handle client visits. Their staff is responsible for assisting with intraday services and stock recommendations.

Table 6: Customer support service details of HSB Securities & Equities Ltd

| HSB Securities & Equities Ltd Customer Support | |

|---|---|

| Registered office address | HSE Securities Limited Door No.3-5-886 to 888 3rd Floor, SL Square, Adj. P.S.R Eye Hospital Himayat Nagar Hyderabad |

| Helpline Number | 040-66510812 66510814 |

| hsesatyourservice@gmail.com | |

In a Nutshell

- When it comes to HSE trading platform dependability, all of your commercial platforms will perform admirably the majority of the time.

- Whether it’s speed, order execution, or features, you can rely on this affordable stockbroker.

- Since the introduction of HSB securities in 1999, many years have gone since its development, and now it has a brand image.

- Discount stockbrokers are excellent for a novice stock trader’s needs.

- HSB Securities is a full-service brokerage firm.

- Though novices may find it useful, they should be aware that the brokerage fees are on the higher side.

Have you used the HSB Securities platform for trading? Share your experiences with HSB in the comments below. If you have any doubts too you can ask in the comments section and our Trading Critique experts will reply to them. Subscribe to our Newsletters for frequent updates from tradingcritique.com.