Monopolies

When one seller or manufacturer retains a dominant position in the market, it creates a monopoly, which results in a lack of competition and few consumer options. Monopsony, on the other hand, occurs when one buyer dominates the market’s purchasing power. On the other hand, oligopolies and duopolies are characterized by a small number of sellers controlling an industry. Market power describes a company’s capacity to shape prices or market dynamics as a result of its dominant position. Abuse of this power, however, may lead to increased costs or the exclusion of rivals.

Competition rules are in place to control monopolies and safeguard consumers from any potential harmful impacts. Government-granted monopolies are approved by the state to promote risky investments or advance national interests. Patents, copyrights, and trademarks are a few examples. Natural monopolies develop when there is little competition in resource-intensive industries because of high costs. And last, a cartel involves several suppliers working together to coordinate services, prices, or product sales, which can likewise alter the dynamics of the market.

History of Monopolies

Throughout history, monopolies have been present in a number of industries. Aristotle is credited with coining the term “monopoly” when he spoke of Thales of Miletus’ dominance over the olive press business. Historical monopolies like the Salt Commission in China and the “Gabelle” in the Kingdom of France had control over salt manufacturing and sales, as notable examples. In regions like Newcastle, Australia, collusion among coal corporations resulted in monopolistic control over coal prices. In the 17th century, Armenian merchants controlled the trade of Persian filoselle, which fueled an increase in trade. Monopolies in the petroleum, steel, and diamond industries include Standard Oil, U.S. Steel, and De Beers, respectively. The Dutch East India Company and Western Union, two companies in the public utility and transportation sectors, have come under fire for their monopolistic practices. Major League Baseball and the National Football League have held legal monopolies in the world of professional sports. These historical monopolies, taken as a whole, have had a significant impact on markets, economies, and consumer welfare.

Understanding Monopolies

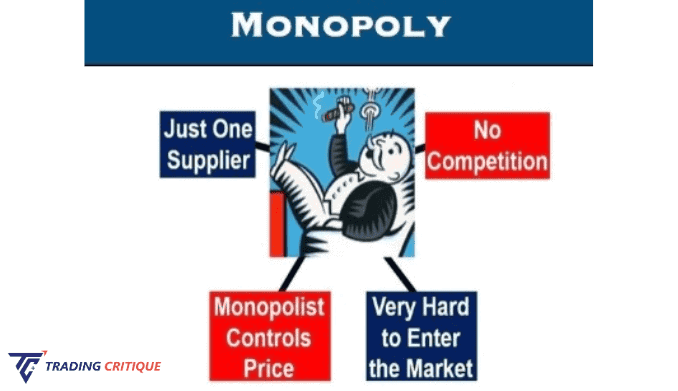

A Monopoly is a specific type of market structure where one company dominates the market, resulting in little to no competition and few or no consumer options. As a result of having extensive control over pricing in this situation, the monopolistic corporation is free to establish prices as it sees fit. Furthermore, Monopolies have the ability to put up obstacles that prevent new competitors from entering the market, strengthening their position of power.

There are two main ways in which Monopolies might develop. The monopolistic corporation first achieves control over the whole supply chain, which includes manufacturing, distribution, and sales, through vertical integration. They can streamline operations and eliminate prospective rivals at various points thanks to this strategy.

Horizontal integration refers to a monopolistic company buying out or combining with other companies operating in the same sector. The monopolistic corporation further solidifies its hold on the market by eliminating rivals and securing its status as the lone producer by absorbing their rivals. The effects of Monopolies can be extensive, affecting customer choice, pricing, and market dynamics. Regulations are frequently implemented to lessen the negative effects of Monopolies and foster just competition in the market.

Regulations of a Monopoly

| Year | Regulation | Description |

|---|---|---|

| 1890 | Sherman Antitrust Act | Enacted to restrict Monopolies and Trusts. Monopolies like the American Tobacco Company and Standard Oil were eliminated. |

| 1914 | Clayton Antitrust Act | Formulated regulations for company directors, mergers, and activities that violate the Sherman Antitrust Act. |

| 1914 | Federal Trade Commission Act | Act of the Federal Trade Commission To set standards for business conduct and uphold antitrust laws, the Federal Trade Commission (FTC) and the Antitrust Division of the U.S. Department of Justice were founded. |

| 1982 | AT&T Breakup | AT&T, a Monopoly supported by the government that controls the country’s telephone service, was compelled to sell off 22 local exchange service providers, fostering competition in the telecommunications industry. |

Various Monopolies

Monopolies are market systems with a single vendor or a small number of sellers that control a large portion of the supply and demand in a certain industry. There are several different kinds of Monopolies, each with its own characteristics in terms of entry barriers and market dynamics, including:

- Pure Monopoly

- Monopolistic Competition

- Natural Monopoly

- Public Monopolies

Pure Monopoly

A pure Monopoly occurs when there are no close substitutes for a single seller’s goods and there are significant obstacles to entry, frequently because of high startup costs. Consider Microsoft Corporation, which until 2022 had a complete Monopoly on personal computer operating systems and maintained a dominant market share with its Windows software.

Monopolistic Competition

In monopolistic competition, several vendors coexist in a market and provide comparable alternatives to their goods. Low entry barriers allow for differentiation through pricing and marketing strategies. Examples include retailers, dining establishments, hair salons, and credit card businesses like Visa and MasterCard.

Natural Monopoly

In a market where it is more cost-effective for one company to produce and provide the good or service, a Natural monopoly develops when a corporation depends on exclusive raw materials, specialized technology, or considerable research and development expenditures. Pharmaceutical firms with patents and high R&D expenditures are seen as natural Monopolies.

Public Monopolies

In the case of utilities, where only one company normally provides energy or water to a region, public Monopolies are organizations that offer necessary commodities and services. Government communities permit and strictly regulate these Monopolies, and tariffs and rate hikes are subject to oversight and control.

Competition Enhancement: EU Approach and Abuse

The objectives of competition law, which are defined by Article 102 of the Treaty on the Functioning of the European Union, are to protect competition in downstream markets, enhance Consumer welfare, and effectively allocate resources. In the two-stage procedure, relevant markets (product and geographic) are defined, and market shares are evaluated to determine dominance. A possible Monopoly is indicated by high market shares. Supply limitations, Predatory pricing, price discrimination, and tying, as well as exploitation, exclusion, and single market abuses, are examples of abuses. The argument focuses on proving a connection between dominance and abusive behavior. Adam Smith’s findings highlight the negative effects of Monopolies on economies and trade.

Monopoly and Efficiency: Effects and Solutions

By setting high prices and limiting output, Monopolies can harm the free market and Consumer welfare by causing deadweight loss and inefficient resource allocation. In order to address this, governmental actions, public ownership, or dismantling Monopolies may encourage competition and improve market efficiency, which will be advantageous to society and consumers.

- Price-Based Oligopoly and Welfare Reduction

- Diminishing Effectiveness and Creativity

- Natural Monopoly and Regulatory Challenges

- State-Granted Monopolistic Privileges

- Rule of Monopoly Termination

- Dismantling Monopolistic Entities

Price-Based Oligopoly and Welfare Reduction

In a Monopoly, the seller sets the highest possible price, which results in deadweight loss—a loss of potential earnings for both the monopolist and customers. This lack of efficiency results from the market being out of equilibrium.

Diminishing Effectiveness and Creativity

Because there is no competition, Monopolies may eventually lose their ability to innovate and become less effective. However, future rivals can come across opportunities to interfere with the Monopoly, stimulating innovation.

Natural Monopolies and Regulatory Challenges

Natural Monopolies are those that develop as a result of high fixed costs and increasing returns to scale. Natural Monopolies can be difficult to regulate, and average-cost pricing is frequently employed to keep prices in check.

State-Granted Monopolistic Privileges

Governments have the power to award private organizations exclusive rights, resulting in government-granted Monopolies. These Monopolies, which are frequently based on patents, trademarks, or copyright, might be either explicit or tacit.

Rule of Monopoly Termination

When the price falls below the average variable cost, suggesting that continuing operations would result in losses, a monopolist should close.

Dismantling Monopolistic Entities

Monopolies can be broken up by fresh competition, customer demand for alternatives, or regulatory intervention. To encourage competition and efficiency, governments may step in, regulate, convert to public ownership, or forcefully break up Monopolies.

Price Discrimination and Using Market Segmentation to Increase Monopoly Profits

A monopolist can boost profits through price discrimination by charging clients who have the means to pay more money. This tactic is used in a variety of sectors, including the pharmaceutical and textbook industries, where different prices are set in distinct marketplaces based on the willingness of consumers to pay. Even though perfect price discrimination is still an ideal, technological and marketing advancements are increasing the likelihood of achieving it. Price discrimination, however, can result in deadweight losses and the exclusion of specific clients, necessitating efficient market segmentation and information collection by monopolists.

Comparison of Monopoly and Perfect Competition

In contrast to businesses that are totally competitive, Monopolies have Market power, which allows them to raise prices above marginal costs. Their downward-sloping demand curves have differing effects on decisions regarding total revenue and output. While Monopolies want to maximize profits, the sensitivity of consumers to price fluctuations restrains their power to control pricing.

| Feature | Perfect Competition | Monopoly |

|---|---|---|

| Marginal Revenue and Price | Price equals Marginal Cost | Price set above Marginal Cost, equal to Marginal Revenue |

| Product Differentiation | Homogeneous products | Unique products with no substitutes |

| Number of Competitors | Many buyers and sellers | Single seller |

| Barriers to Entry | Free entry and exit | High barriers to entry |

| Elasticity of Demand | Perfectly elastic demand | Relatively inelastic demand |

| Excess Profits | Short-term excess profits possible, but competition erodes | Can maintain excess profits due to entry barriers |

| Profit Maximization | MR = MC | MR = MC |

| Supply Curve | Well-defined supply curve | Lacks a distinct supply relationship |

| Market Power | Zero Market power, price takers | Significant Market power, price maker |

A Monopoly’s Traits are as follows:

Monopolists set their output or price at the point where marginal cost (MC) and marginal revenue (MR) are equal in order to maximize profits. In the elastic range of demand, this frequently happens when total income exceeds all costs, producing anomalous profits.

Monopolies have the ability to regulate the quantity of their goods or products delivered in order to set the price of those goods or products at the desired level.

High Barriers to Entry: Monopolies keep their Monopoly status by erecting formidable obstacles that keep rival vendors from entering and competing in the same market.

Single Seller: There is only one seller in a monopoly who provides the entire market with all of the output. As a result, the company successfully transitioned into the industry.

Price discrimination: Monopolists may alter the price or output of their product depending on the elasticity of demand. They might offer more products at cheaper prices in highly elastic markets and fewer products at higher prices in less elastic markets.

Other Examples of Monopolies

Monsanto

Monsanto, which holds 70% to 100% of the commercial GMO seed market for several crops, is being sued by other companies for Antitrust and Monopolistic practices. For its “embrace, extend, and extinguish” policy,

Microsoft

Microsoft was the target of numerous Antitrust lawsuits. The European Commission penalized it with 493 million euros in 2004 after it settled a U.S. Antitrust lawsuit, and there were additional fines imposed in later years for noncompliance.

AAFES

AAFES: Controls all retail sales at American military locations abroad.

The Walt Disney Company

One of the largest media and entertainment giants in the world, The Walt Disney Company, has amassed a huge array of properties, businesses, and corporations. In 2019, The Walt Disney Company controversially bought the majority of the assets of 20th Century Fox.

Government-Controlled Alcohol Retail Monopolies

State-controlled businesses that sell alcohol to the public include Vinmonopolet in Norway, Systembolaget in Sweden, Alko in Finland, VNB in Iceland, the LCBO in Ontario, SAQ in Quebec, and the Liquor Distribution Branch in British Columbia, among others.

Pros and Cons of Monopolies

Through economies of scale, Monopolies provide price stability and cost advantages, but they may also abuse their position to restrict options and manipulate pricing. Due to a lack of competition, consumers may experience decreased product quality and limited innovation.

Pros of a Monopoly Pros of a Monopoly |  Cons of a Monopoly Cons of a Monopoly |

|---|---|

| Price Stability: Monopolies can establish constant and dependable prices in the absence of competition, giving customers certainty. | Artificial Scarcities: Dominant companies can create artificial scarcities to control supply and manipulate prices. |

| Economies of Scale: Monopolies benefit from cheaper unit costs thanks to their ability to produce enormous volumes, improving planning and policy formulation. | Price Fixing: Monopolies may engage in price-fixing, leading to higher prices for consumers. |

| Innovation Investment: Companies are able to secure their investments in innovation while operating as a monopoly free from external competition. | Lower Quality: Limited competition can result in lower-quality products as there is no incentive to improve. |

In a Nutshell

- A product is under the sole control of a seller or maker, barring rival businesses from offering the same thing.

- Monopolies have the power to set prices without being constrained by competition, which results in greater costs and worsening customer welfare.

- Monopolies limit customer choice and innovation by putting barriers in the way of potential competitors.

- Monopolies should be limited and regulated to avoid gaining too much influence and abusing customers.

- Antitrust regulations encourage open competition, fostering creativity, reducing costs, and raising standards.

- Consumers are protected by Antitrust laws from monopolistic businesses’ exploitation.

- Power concentration is prevented by Antitrust regulations, promoting a diversified and competitive corporate environment.

- Antitrust laws promote entrepreneurship, new business development, and economic progress.

- Antitrust regulations prevent Monopolistic practices from distorting the market.

- Antitrust laws safeguard consumers, advance Economic efficiency, and encourage a competitive market that is advantageous to society.

Explore our Trading Critique Website for essential trading resources, investment insights, expert tips, and powerful trading strategies. Seize this opportunity to elevate your trading prowess and conquer your financial goals.

Frequently Asked Questions

1. Describe Monopolist

A person, group, or company that has complete control over the market for a particular good or service is referred to as a monopolist. Monopolists frequently back legislation that gives them more power and market sway. Monopolists are unable to improve the quality of their products because there is no competition.

2. What is the Clayton Antitrust Act, and What Does it entail?

The U.S. Congress passed the Clayton Antitrust Act in 1914, and it is a significant piece of legislation that addresses unethical economic practices, including Monopolies and Price fixing. It also aims to protect workers’ rights.

The Clayton Antitrust Act’s provisions continue to have a considerable impact on American business practices, and the Federal Trade Commission (FTC) and the DOJ’s Antitrust Division play crucial roles in implementing these rules.

3. Is it against the Law to have a Monopoly?

Monopolies are considered criminal if they take advantage of consumers by charging extravagant prices for subpar goods. Government involvement therefore aims to deter and eliminate such Monopolistic practices. However, there are other industries where Monopolies are owned by the government, including those in the oil, gas, water, and electricity sectors. These businesses’ monopolistic position is legitimate since they must adhere to laws and government directives.