Identify Forex Scams in Simple Steps – Trading Critique

A forex trading scam is a scheme that tries to trick you by giving you money in the forex market. Scammers promise you to give high returns or guarantee profits. But this is unrealistic.

Back To Top

E*TRADE is one of the US-based multi-asset trading broker platforms. They provide a variety of trading options and a lot of account types for different kinds of users. Here, tradingcritique.com gives the best and detailed Product Guide of E*Trade broker.

E*TRADE (https://us.etrade.com/home) is one of the first online brokerages in the United States (US). It was founded in 1982 with its headquarters in the United States. E*TRADE Retail branches are 30 across the United States with 4,100+ employees. It has two excellent mobile apps with good features and three computer-based platforms for traders. An Etrade trading platform called are Power E*Trade has exclusive options.

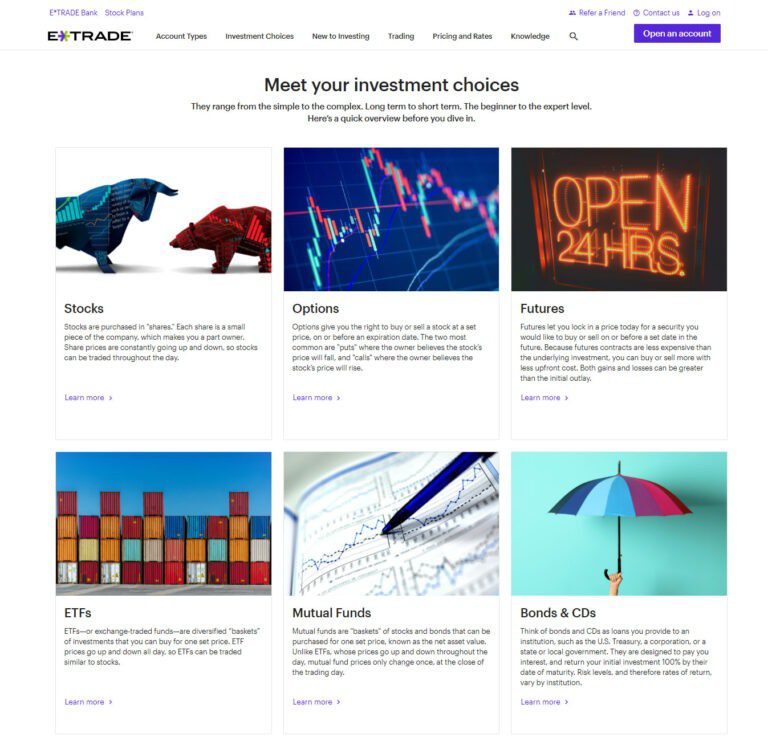

E*TRADE is suitable for Beginners, Investors and Frequent traders. They offer trading Investment Choices such as Stocks, Options, Mutual Funds, ETFs, Futures, and Bonds. They provide 24/7 customer service by financial consultants via Email, Live chat, Phone calls, and FAQ page.

Image 1: Home page on E*TRADE website.

E*TRADE Securities LLC. (ETS) is registered with the Securities and Exchange Commission (SEC) as Broker-Dealer. E*Trade is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

SIPC protects the Etrade customer accounts up to $500,000, including $250,000 for claims for cash as Etrade is a member of the Securities Investor Protection Corporation (SIPC). They also provide Fraud protection, which means they cover the losses incurred by their unauthorized use of brokerage, banking, or lending services.

E*TRADE provides encryption and network security for their account types, and personal details are protected when using the website. They also offer Privacy protection and two-factor authentication when logging in.

E*TRADE sends instant notifications for transactions, stock, news, and portfolio alerts in your account via email. If they suspect that your account is a target for fraud, they will send you a higher priority security alert.

E*TRADE received various awards in its years of functioning, and it is recognized by famous awarding platforms, websites, institutions, magazines, etc.

Table 1 : Awards received for the Excellency of E*Trade awarded by various domains

| Awards | Awarded by |

|---|---|

| Best for Mobile Trading | Barron’s Annual Online Broker Survey 2021 |

| #1 Trader App | StockBrokers.com 2021 |

| #1 Options Trading | StockBrokers.com 2021 |

| #1 Web Trading Platform | StockBrokers.com 2021 |

| Best Brokerage for Beginners | Benzinga’s 2020 |

| Best Robo-Advisor for Mobile Experience | Investopedia |

When you start trading with Stocks, it allows you to own a part of the companies from which you bought the stocks. When stock performance changes, successful stocks will help your money grow, and sometimes they will outperform inflation. It allows you to decide which company to invest in, when to buy, and when to sell.

ETRADE offers every ETF sold with tools and guidance to help you quickly find the right ones for your portfolio. Here you can trade with ETF at low or zero commission. They are trading on major exchanges, so it is easy to buy and sell stocks.

E*TRADE allows you to choose from thousands of mutual funds for the trade without multiple burdens and transaction fees. They provide tools to help you quickly find the funds that will help you achieve your goals. Using Automated Investment, you can buy funds in your schedule, at regular intervals, and in equal volumes.

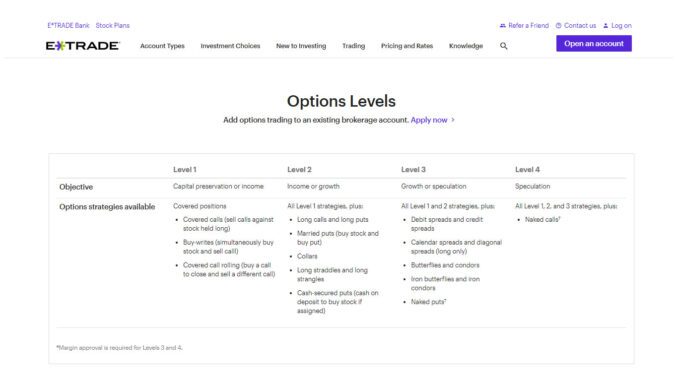

Etrade provides award-winning trading tools for trading options on stocks, indexes, and futures.

Image 3: Options levels in E*TRADE.

E*TRADE provides future trading with different instruments. You can access future trading from world markets. They offer the best trading platforms and attractive trading tools for future trading. You can’t directly trade with futures. They provide request options for future trading, via their customer support (877-553-8887).

E*TRADE offers direct access to over 50,000 bonds and fixed income products from all types of providers. There is no commission fee for US Treasury and new issue bond trades.

Image 4 : Markets assets in E*TRADE

E*TRADEplatform is one of the best trading platforms in the market. It also has an award-winning trading platform called Power ETRADE. The Power E*TRADE platform is Designed to run on both mobile and web. It has more powerful tools and alerts. For beginners, it is easy to handle and access.

ETRADE mobile has two platforms as Power E*Trade and E*Trade. The Power E*Trade is nothing, but it is the advanced version of E*Trade. It has some additional features added, otherwise, both have the same functionality.

ETrade mobile app is available and supported in Apple App Store (iOS) and Google Play (Android) devices, including the Apple Watch and leading tablet devices. You can invest in stocks, ETFs, mutual funds, and options. It allows you to manage cash with Transfer Money, check deposits, and Bill Pay. It offers advanced mobile features like View Bloomberg TV, third-party research, and breaking news.

The Power E*TRADE is Designed for more advanced trading. Its handling is very easy and customizable. You can start rapid trade with stocks, ETFs, Simple and Complex options, and futures on a single trade ticket. It provides access to market movement with streaming quotes, news, earnings, dividends, in-depth views, gains, and more. Mobile apps were available on Apple App Store (iOS) and Google Play Store (Android).

E*TRADE Web trading is easy to access with lots of features, but they do not offer a desktop platform. It is a fixed one and you can’t customize it. They provide two-step authentication for secure login. They have a search option that is too good here. You can be able to set up alerts and notifications from the Set & Manage Alerts page.

Image 5: Web platform in E*TRADE

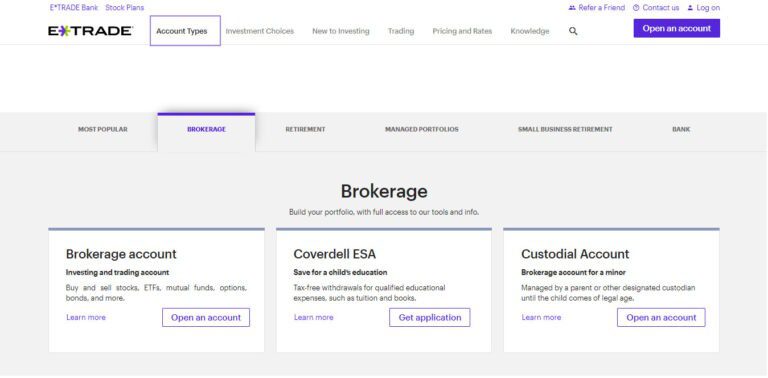

E*TRADE offers a lot of various account types with sub-account. Their account plans are suitable for different kinds of investors and traders. These types of accounts are planned based on traders, investors, and trading instruments.

Brokerage account provides 3 different types of accounts for Children’s Education and Future.

Image 6: Brokerage account types in E*TRADE

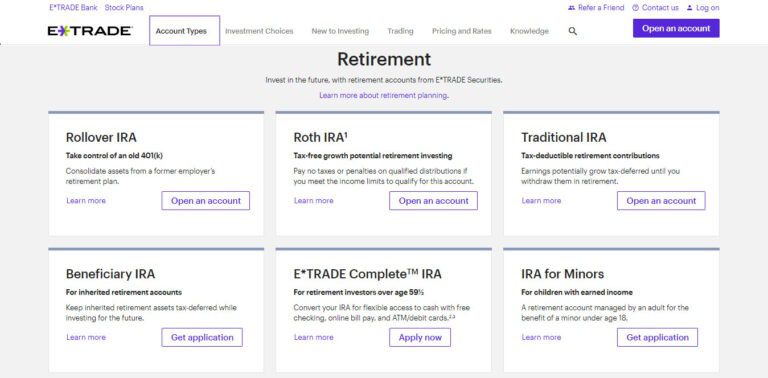

The Retirement Account is based on a future investment plan. It has a long-term investment process. There are 6 types of accounts available here.

Image 7: Retirement account types in E*TRADE

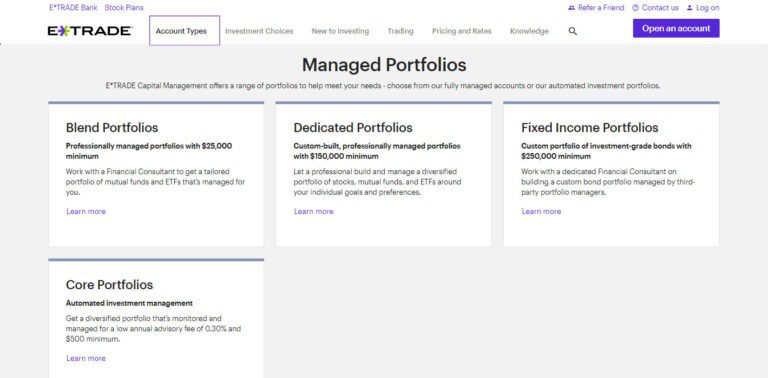

This account was fully based on portfolios, E*TRADE offers 4 account types.

Image 8: Managed Portfolios types in E*TRADE

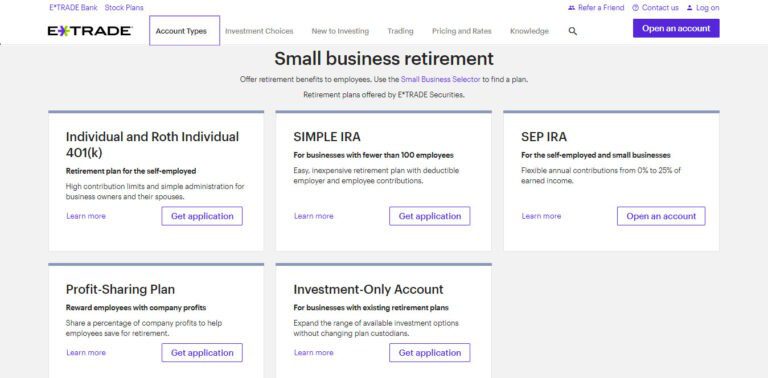

These types of accounts are suitable for workers or employees.

Image 9: Small Business Retirement types in E*TRADE

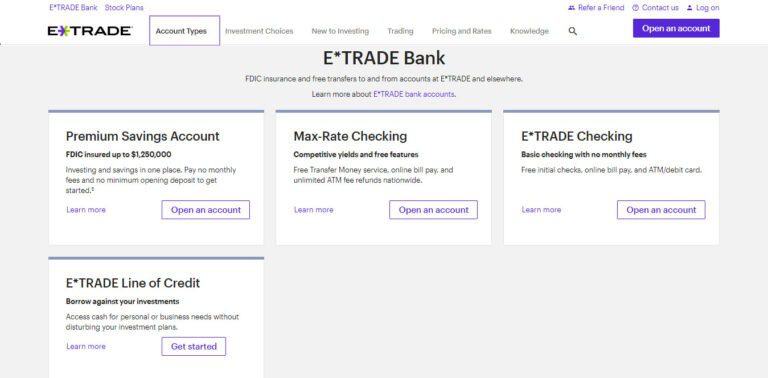

Types of Bank Accounts:

Image 10: Bank account types in E*TRADE

E*TRADE offers four ways to transfer funds with different methods. They are,

Wire Transfer is a fast and secure method for funding. It has transferred money between accounts and different financial institutions. While using this type of transaction, the transaction time is the same business day.

Transfer Money is a free online service for money transfers between two accounts. When using the Transfer Money method for a deposit, time duration takes up to a maximum of 3 business days.

They do not charge a withdrawal fee, except wire transfer. There is no card or e-wallet transaction in E*TRADE.

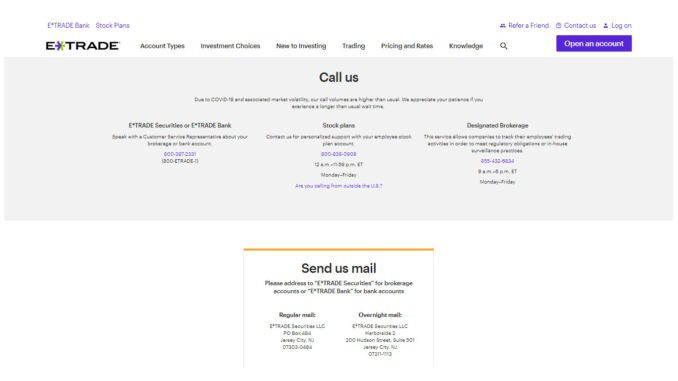

E*TRADE offers 24/7 customer support via Phone call, Email, Live chat, and FAQ page. Currently, they provide a limited live chat option only. The response time is good, and they reply to Emails in a maximum of 1 day. Also, the FAQ page has answers that are relevant to questions.

Table 2: Phone numbers to contact ETrade State wise in USA

| State | E*Trade Contact Number |

|---|---|

| International Phone Number | 800-387-2331 |

| UNITED STATES | |

| Scottsdale, AZ | 1-866-789-0723 |

| Brentwood – Los Angeles, CA | 1-866-789-0719 |

| Costa Mesa, CA | 1-866-789-0713 |

| Cupertino, CA | 1-866-789-0786 |

| La Jolla, CA | 1-866-789-0728 |

| Palo Alto, CA | 1-866-789-0725 |

| Roseville, CA | 1-866-789-0735 |

| San Francisco, CA | 1-866-789-0724 |

| Torrance, CA | 1-866-789-0731 |

| Denver, CO | 1-866-789-0720 |

| Washington, DC | 1-866-789-0726 |

| Orlando, FL | 1-866-789-0722 |

| Fort Lauderdale, FL | 1-866-789-0732 |

| Tampa, FL | 1-866-789-0783 |

| Atlanta, GA | 1-866-789-0714 |

| Chicago, IL | 1-866-789-0712 |

| Boston, MA | 1-866-789-0721 |

| Farmington Hills, MI | 1-866-789-0729 |

| Edina, MN | 1-866-789-0739 |

| Morristown, NJ | 1-866-789-0762 |

| arden City, NY | 1-866-789-0733 |

| 42nd Street – New York, NY | 1-866-789-0716 |

| Rockefeller Plaza – New York, NY | 1-866-789-0785 |

| Scarsdale, NY | 1-866-789-0737 |

| Charlotte, NC | 1-866-789-0738 |

| Portland, OR | 1-866-789-0781 |

| King of Prussia, PA | 1-866-789-0734 |

| Dallas, TX | 1-866-789-0715 |

| Houston, TX | 1-866-789-0740 |

| Seattle, WA | 1-866-789-0730 |

E*TRADE conducts events on a 1-hour basis via Webinar. The Newsroom educates markets related insights, videos, and press release news. They provide high-quality educational materials, and it covers a wide range of topics.

The videos and educational articles provided by E*TRADE are suitable for beginners and provide useful content. In the knowledge section, they explain markets assets, retirement planning, and future trading plans.

Individually they explain all the products and instruments. Also, they provide how to use and handle their platform with a full path.

Image 12 : Knowledge section in E*TRADE

A forex trading scam is a scheme that tries to trick you by giving you money in the forex market. Scammers promise you to give high returns or guarantee profits. But this is unrealistic.

An index fund is a collection of investments that follows the performance of a group of companies or a market index. For example, the S&P 500. It is like a large basket of investments that mirrors the performance of these selected companies. Instead of choosing individual stocks, the fund follows preset rules set by companies like S&P Dow Jones Indices.

Forex trading (foreign exchange trading) is the act of buying and selling currencies globally. In this guide, we will explain forex scams, how to spot a forex scam, and tips to avoid them.

Small enterprises can attract seasoned and skilled candidates by providing straightforward, dependable, and adaptable retirement schemes. Certain types of plans can even provide tax benefits. Here, we will explore the different types of retirement plans available to small businesses and how to establish them.

Foreign exchange trading involves exchanging one currency for another. By profiting from fluctuations in exchange rates between currencies, forex traders aim to generate returns on their investments. It operates 24 hours a day as currencies are traded across time zones.

Systematic investment plans offer a systematic approach to investing that allows individuals to invest a fixed amount of money in their preferred investment instruments on a regular basis. SIPs have several benefits including steady investment, versatility, the possibility of dollar-cost averaging, and the opportunity to start with small amounts of money.

When you start trading with Stocks, it allows you to own a part of the companies from which you bought the stocks. When stock performance changes, successful stocks will help your money grow, and sometimes they will outperform inflation. It allows you to decide which company to invest in, when to buy, and when to sell.

ETRADE offers every ETF sold with tools and guidance to help you quickly find the right ones for your portfolio. Here you can trade with ETF at low or zero commission. They are trading on major exchanges, so it is easy to buy and sell stocks.

E*TRADE allows you to choose from thousands of mutual funds for the trade without multiple burdens and transaction fees. They provide tools to help you quickly find the funds that will help you achieve your goals. Using Automated Investment, you can buy funds in your schedule, at regular intervals, and in equal volumes.