What Is Stock Trading and How Does It Work

Stock trading involves buying and selling company shares to make a profit, and it can be risky, especially if you lack basic stock market knowledge, research skills, and analytical thinking.

Back To Top

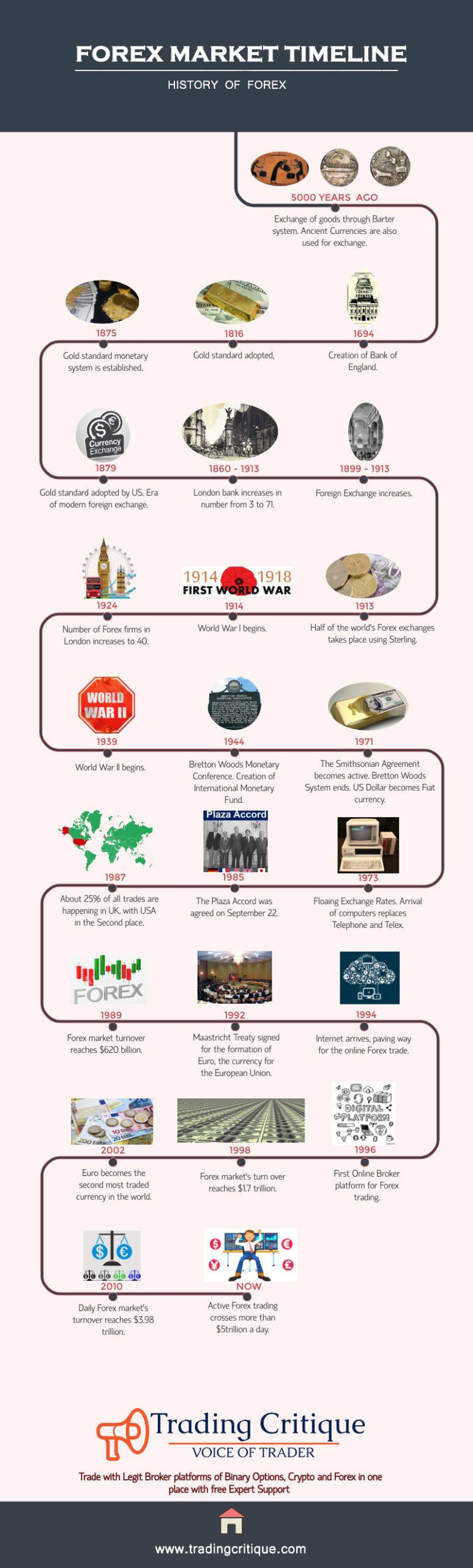

Foreign exchange (forex) refers to the global market where currencies are traded. Forex is the largest and most liquid market in the world, with trillions of dollars exchanged every day. Forex trading involves buying and selling currencies in order to profit from fluctuations in exchange rates. Factors that influence exchange rates include geopolitical events, central bank policies, and economic indicators. Traders can access the forex market through brokers or trading platforms, and can trade a variety of currency pairs such as USD/EUR, USD/JPY, and GBP/USD. Successful forex trading requires knowledge of market analysis, risk management, and trading strategies.

WARNING: Trading is highly risky. If you invest without knowing what it is, you might lose a lot of money. Use your tradingcritique.com to learn properly about what you’re trading and then start your trading. When you use proper trading strategies you can increase your profits via any type of trading.

WARNING: Trading is highly risky. If you invest without knowing what it is, you might lose a lot of money. Use your tradingcritique.com to learn properly about what you’re trading and then start your trading. When you use proper trading strategies you can increase your profits via any type of trading.

Welcome to our website dedicated to foreign currency trading! If you want to diversify your investment portfolio and potentially earn significant returns, trading foreign currencies could be a great option. In this guide, we’ll explore the basics of foreign currency trading and how you can get started.

Foreign currency trading, also known as forex trading, involves buying and selling currencies worldwide. Forex trading aims to profit from changes in the exchange rate between two currencies. For example, if you believe that the Euro will increase in value compared to the US dollar, you will buy euros and sell dollars.You would sell your euros for a profit if your prediction is correct.

There are many reasons why investors choose to trade foreign currencies. Forex trading is a 24/7 market, meaning you can trade anytime, making it a flexible investment option. Additionally, forex trading offers high liquidity, which means you can easily buy and sell currencies without worrying about finding a buyer or seller. Forex trading also offers high leverage, which can amplify your potential returns.

You’ll need to choose a reputable forex trading broker to start with forex currency trading. A forex broker is a company that provides traders with access to the forex market. When choosing a forex broker, it’s important to consider factors such as regulation, fees, trading platforms, and customer support.

Once you’ve chosen a forex broker, you must open a trading account and deposit funds. Most forex brokers offer demo accounts, allowing you to practice trading with virtual funds before risking your money. This can be a great way to get started and learn the ropes before trading with real money.

Staying informed about FX currencies is essential for successful trading. Many resources are available to help you stay up-to-date on the latest trends and news in the market. These include:

These provide information on upcoming economic events and announcements that can impact currency values.

News outlets such as Reuters and Bloomberg provide real time news and analysis of the FX market.

This involves using charts and technical indicators to analyse historical price movements and identify potential trading opportunities.

This involves analysing economic and political factors that can impact currency values, such as interest rates, inflation, and government policies.

Foreign currency trading can be a great way to diversify your investment portfolio and potentially earn significant returns. By understanding the basics of forex trading and choosing a reputable broker, you can get started confidently. We hope this guide has provided you with valuable insights into foreign currency trading and how you can get started.

Looking for the best forex trading platform? Look no further than Trading Critique. Our platform is designed to provide traders with a user-friendly interface, powerful trading tools, and real time market data. With Trading Critique, you can access advanced charting and technical analysis tools, customizable trading strategies, and a wide range of currency pairs to trade. Our platform is also highly secure and offers reliable execution of trades. Whether you’re a seasoned trader or just getting started, Trading Critique has everything you need to succeed in the forex market. Try us out today and experience the difference for yourself!

What is forex trading? Forex trading, which stands for foreign exchange trading,...

Read MoreThe Forex market's volatility offers a plethora of profit-making opportunities, but it...

Read MoreThe International currency exchange market is called foreign exchange, or forex. With...

Read More

The FOREX refers to the set of foreign currencies and exchange. Forex market decides foreign exchange rates for every foreign currency. It combines all aspects of buying, selling and exchanging currencies. Foreign currencies are always traded in pairs, Therefore the foreign exchange market does not set a currency’s fixed value but rather conclude its floating value by setting the market price of one currency if paid for with another like US$1 —> X GBP or AUD etc. Forex markets help international trade and investments by allowing currency conversion. For example, It permits a business in the United States to import goods from the United Kingdom and get paid in GBP, even though it’s income is in USD based on the differential interest rate between two currencies.

Forex market always holds the place of the world’s largest financial market. It’s basically the currency trading. Forex traders buy and sell currencies of different countries for profit. Daily, about 5 trillion US dollars are traded. Forex trading in simple words is the exchange of different currencies when you travel between countries. During travel, you pay your own currency to your destination currency, and there will be a difference in the value of the currency when you exchange it. This difference in the value of exchange in the currency determines the profit in the Forex trading.

Forex trading is a vast trading market. Enormous numbers of customers around the globe are engaged in forex trading daily. If you are a beginner or experienced trader you will be finding it difficult to select the best forex broker or best profitable system to trade in forex. Here tradingcritique.com helps you to learn the basics to choose the best broker from the vast on your choice.

In this introduction, tradingcritique.com helps you to know the forex trading tips and strategies applicable to forex trading or currency exchange.

The foreign exchange market offers the trader the ability to figure out movements in trading markets and particular economies or regions. FOREX has not centralized markets so it offers best trading opportunities for the traders.

Liquidness – In this Forex market there is a standard volume of over $3.57 trillion traded per day. So there is plenty of trades and moves you can make.

Diverseness – There are eight major global currency pairings available in the Forex market. Also, markets have other regional currency pairings available for trade. More choice, better opportunity to earn the profit.

Openness – The forex market is always open. They work twenty-four hours a day, five days a week. So you can decide when to trade and how to trade.

Leverage – A remarkable amount of forex currency pairings are traded every day. This is because leverage can help you buy and sell large quantities of currency. More the quantity, more the potential profit or loss.

Minimal commissions – Forex offers low costs and fees compared to other markets. Some brokers don’t charge commission at all, you pay just the bid/ask spreads.

PIP: Pip means ‘Percentage in point’ which refers to the smallest change in the value of the currency pair. The trades happening in the Forex market is mainly based on the fractional changes in the value of the currencies. All the currency pairs have up to four decimal points. The pip value is calculated by the changes of the value in these decimal points of currency pairs. A single value of a pip is the change of one value in the last digit of the decimal in the currency pair. E.g. if EUR/USD is bought at the value of 1.4330 and the currency pair is sold later at the value of 1.4333, the difference in the trade taken place is +3pips profit. The profit of the Forex trade is said in terms of the pip value. If the quote currency of any currency pair is USD, then the value of one pip equals to 1/100 of a cent. The JPY currency always has only two decimal points. So, when JPY corresponds to quote currency in the currency pair, then the pip value is calculated according to the difference in the two decimal points that take place during the Forex trade.

Ask Price and Bid Price: To buy a specific currency pair in the Forex market platform a Quotation is given as the Forex quote. E.g. the quote for EUR/USD is given as 1.4333/34. In this quote, the first given price 1.4333 is the Bid price and the second given price is the Ask price which has the value 1.434. The bid price is the one at which the trader can sell the currency pair. In this case, the trader can sell 1 Euro for 1.4333 US Dollars. Ask price is also known as offer price, is the price at which the trader can buy the currency pair. In this case, the trader can buy 1 Euro for 1.4334 US Dollars. The difference in the Ask price and Bid price is the dealing spread

Finding the best Forex broker always depends on an individual liking. It may come down to the currency pairs you need to trade, the platform or simple use of requirements. Tradingcritique.com have listed the comparison factors, everything is considered to be important for trading online.

Minimal Trading Costs

The profit generated on a single trade can be cut down through spread, commission or overnight fees. To compare the best low fees among your brokers choice. Inactivity or Withdrawal fees also should be considered while selecting the broker of your choice.

Trading Platform

The trading platform needs to suit you. You have to choose whether you want simple cut down interface or multiple built-in features, widgets and tools. Demo accounts are a great way to try out multiple platforms and see which works best for you.

Mobile Trading

Trading forex while moving will be best for some people. Most brokers offer a mobile app, normally adaptable to IOS, Android and Windows. The App is a full version just like the website and there won’t be any features missed out.

Customer Service

Check for customer care whether they have language you prefer, live chat, email and telephone support. Check there availability by day time and hour. It should all be based upon your priority.

Asset List

You have to check for the assets or currency pairs you wish to trade. Every broker platform will have the major currency pairs but if you wish to trade on unfamiliar currency pairs you have to go through the platform’s asset lists.

Regulation

Looking for the broker regulated by a particular body like FCA, SEC or ASIC? European regulation might impact some of your leverage options, so this may impact more than just your peace of mind.

Spreads or Commissions

The spreads are often a comparison factor on their own. If you trade 3-4 different currency pairs and no single broker has the tightest spread for all of them. Instead, you can have multiple accounts to take advantage of the best spreads on each trade.

Payment Acceptance

There are so many deposit methods in forex broker platforms like Skrill, Neteller and Paypal. You can also use Credit or Debit card for making a deposit. Nowadays brokers accept bitcoin or crypto for deposits.

Security

Every broker follows regulatory demands to separate client and company funds and they promise a certain level of security for user data. Security should be looked into consideration as Forex also have some unregulated brokers.

Demo Accounts

Try before you start. Many brokers offer demo account for easy access to the traders when they start with their real accounts. This gives some training for the traders at the start.

Account types

Account type can be varied like cash, margin or PAMM accounts to Bronze, Silver, Gold and VIP Levels. The differences can be reflected in costs, minimal spreads, settlement or different leverage. Retail forex and professional accounts will be treated very differently by brokers and regulators.

Leverage

Forex leverage is capped at 1:30 by most of the brokers in Europe. Assets like Gold, Silver and Oil are capped separately. In countries like Australia, forex leverage is capped at 1:500 so this makes a huge difference in deposits and potential profits or losses.

Tools or Features

Brokers offer a range of tools like future pricing or bespoke trading robots to appreciate the better trading experience for traders. Here the broker choice purely depends on the individual. Level 2 data is also an important tool, so you can give preference to the brokers who deliver it.

Education

Brokers also offer education to their traders through e-books, pdf documents, live webinars and expert advisors. So you have to analyse these things before opening an account.

Bonus

The broker offers cashback, no-deposit bonus or free trades as a promotion. Regulatory bodies have changed all that. Bonuses are now few and far between. Check for the terms and conditions before you accept a bonus from the brokers and decide whether to over trade or not.

Execution Speed

Desktop platforms perform excellent speed of delivery in results rather than a mobile app. But you can check before proceeding by testing with the broker.

In Forex trading the trade between the currencies is always done in pairs. When one currency is bought, the other currency is meant to be sold. These currency pairs are mostly made up of the Major currencies of the Forex market. There are many currency pairs offered by different Forex trading platforms.

In these currency pairs, the first currency is the Base currency and the second one is the quote currency. The currency pair means ‘How much Quote currency is required to exchange for the Base Currency’. Here the Quote currency is the foreign currency. E.g., EUR/USD 1.4300 means that one Euro is traded for 1.43 USD.

Base Currency: The first in the currency pair is the Base currency. This is the primary currency and it’s always calculated against the exchange of Quote currency for the Base Currency. The basis of buying and selling trade of a currency is decided on the Base currency. If the value of a Base currency is predicted to be higher in the Forex market it is bought and when the value of a Base currency is predicted to get low its sold. The dominant Base currencies used for trade-in Forex in the descending order of frequency are EUR, GBP and USD.

Quote Currency: The second of the currency pair is said to be the Quote currency. The quote currency is basically the foreign currency to be exchanged with the Base currency. In the ‘buy and sell’ trade of the Forex market, the Quote currency is sold to buy the Base currency in the ‘buy’ trade whereas in the ‘sell’ trade the Quote currency is bought and the Base currency is sold.

Vital Currency Pairs

In the Foreign exchange market, the majority of traders focus on the seven most liquid currency pairs. Top four major currency pairs are:

EUR/USD (Euro/US Dollar)

USD/JPY (US Dollar/Japanese Yen)

GBP/USD (British Pound/US Dollar)

USD/CHF (US Dollar/Swiss Franc)<br< span=””></br<>

Next 3 rising currency pairs are:

AUD/USD Australian Dollar/US Dollar

USD/CAD (US Dollar/Canadian Dollar)

NZD/USD (Newzealand Dollar/US Dollar)

These are the topmost currency pairs and USD is listed along with all currencies as it is the world’s leading reserve currency, playing a major role in 90% of currency trades.

Peripheral Currency Pairs

If a currency pair does not include the US dollar, it is known as a ‘Peripheral currency pairs’ or a ‘cross-currency pairs’.

EUR/GBP (Euro/British Pound)

EUR/AUD (Euro/Australian Dollar)

GBP/JPY (British Pound/Japanese Yen)

CHF/JPY (Swiss Franc/Japanese Yen)

Regulation should always be an important consideration. ESMA (European Securities and Markets Authority) have imposed strict rules on forex firms regulated in Europe.

Whether the regulator is inside or outside of Europe, it’s going to have serious consequences on your trading. The other important regulatory bodies in and around Europe are,

ESMA have jurisdiction over all regulators within the EEA ( European Economic Area ).

The rules include caps or limits on leverage and vary on financial products. Forex leverage is capped at 1:30 (Or x30). Outside of Europe, leverage can reach 1:500 (x500).

Traders in Europe can apply for Professional status. This removes their regulatory protection and allows brokers to offer higher levels of leverage.

Outside of Europe, The largest regulators are

These cover the bulk of countries outside of Europe. Forex brokers catering for India, Hong Kong, Qatar alone can be regulated by any one of the regulators mentioned above. Some brands are regulated across the globe (one is even regulated in 5 continents). Some bodies issue licenses and others have a register of legal firms.

So to reiterate, an ASIC forex broker can offer higher leverage to a trader in Europe.

CHOOSING CURRENCY TO TRADE

Traders should stick to trade in Minor or Major pair currencies at the start. This will be easy and spreads will be minimal and making scalping applicable.

Exotic pairs have more illiquidity and higher spreads. As it is riskier you can make some serious cash with this exotic pairs but be ready to lose huge in a single session too.

The logic of forex trading is almost identical to every other trading markets. But there is one crucial difference to highlight. When you trade currency in forex, you’re buying a currency, while selling another at the same time. So that is why the currency is marketed in pairs. So, the exchange price you see from the signal represents the difference in purchase price between two currencies.

Forex contracts come in a range of types

Spot forex contracts

The conventional contract. Delivery and Settlement is immediate.

Futures forex contracts

Delivery and Settlement takes place on a future date. Prices are agreed directly, but the actual exchange is in the future.

Currency swaps

Where two parties can ‘swap’ currency, often in the form of loans, or loan payments in differing currencies.

Options forex contracts

An option gives a trader, the option to exchange currencies at a certain price on a date in the future.

There are many different types of forex orders, which traders use to manage their trades. These may vary between different brokers, there tend to be several basic FX order types all brokers accept. Order types allow for bespoke trading styles that can provide equanimity for the trader.

Market Orders

The market order is apparently the most basic and often the first FX order type traders come across. Just as the name suggests, market orders are traded at market. If you want to get into the forex market immediately, you can trade a market order and be entered at the current price.

Entry Orders

The next most common FX order type is the entry order. They can be set away from current market prices. If price trades at the pre-selected price, the criteria for the entry order will be met and a new position will be created. Normally entry orders can be used for breakouts or with other strategies that demand execution when price passes a certain point.

Limit Orders

Limit orders to open a trade – This is a limit entry order to get a better entry price

Limit orders to close a trade – This is limit exit order to get a better price at closing your trade on your favour.

Stop Orders

Stop orders to open a trade – This stop order to enter into the market. These orders can be used for trading breakouts.

Stop orders to close a trade – This is used as a protective stop order to close a trade when the market moves a specified amount against your position.

Cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP) are traded as the currency pair against US dollar. These can be traded just like other FX pairs.

Charts will play an essential role in your technical analysis. You have to identify the time frame and it allows you to identify opportunities at ease. The right chart will be heading to the right price.

Position Trading – It is a longer-term trading approach where you can hold trades for weeks or even months. As a position trader, you mainly rely on fundamental analysis in your trading (like NFP, GDP, Retails Sales, etc.) to give a preference.

Swing Trading – It is a medium-term trading strategy where you can hold trades for days or weeks. As a swing trader, your involvement is to capture a “single move” in the market.

Day Trading – It is a short-term trading strategy where you’ll hold your trades for minutes or even hours. As a day trader, your involvement is to capture the intraday volatility.

Scalping – It is a very short-term trading strategy where you’ll hold your trades for minutes or even seconds. As a scalper, your involvement with what the market is doing now and how you can take advantage of it.

The Forex trading sessions are broken up into four major trading sessions.

Sydney Session – Open 7 AM – Close 4 PM

Tokyo Session – Open 9 AM – Close 6 PM

London Session – Open 8 AM – Close 4 PM

Newyork Session – Open 8 AM – Close 5 PM

There is no academies or schools to teach trading. It will become up only with practical knowledge. Mistakes are the best lesson to build your knowledge of forex trading. For the newcomers, you can go through Podcasts, Blogs, Online trading courses, Ebooks, Seminars, Books, Forums, Chat rooms and Newsletters.

Money Management

The profitable forex strategy will require an effective money management system. The first technique is to never trade more than 1-2% of your account on a single trade. So if you have $1000 on your account do not risk more than $20 on a single trade. So a string of bad results would not blow your capital. Once you have developed in your analysis and strategy you can increase your risk criterion.

Computerization

Computerized forex trades could better your returns if you have developed a frequently effective strategy. It is because the bot or an algorithm will place trade rather than entering the trade manually with perfect enter and exit positions as the pre-determined criteria have been met.

Webinars and Training Videos

You can gain experience from seeing videos of the trading experts. This is because webinars and videos get you through setups, price action analysis, plus the best signals and charts for your strategy.

There is a lot of software for forex traders. Cost and benefits will be the main considerations.

MetaTrader 4

AlgoTrader

TradingView

NinjaTrader

These platforms help Mac or Windows operating system users. There are other specific applications for Linux users.

FOREX TRADING IS IT PROFITABLE? LET TRADINGCRITIQUE.COM ANSWER YOU

It purely depends upon the trader’s strategy and how long you will wait for making a profit. Some end up losing as they look to earn profit at a quick time. Some get huge returns as they will analyse the time frame and so they will possibly turn the investment to profit. It is possible to make money trading forex, but there are no guarantees. 30-35% of retail traders lose money.

Stock trading involves buying and selling company shares to make a profit, and it can be risky, especially if you lack basic stock market knowledge, research skills, and analytical thinking.

What is a mutual fund? A mutual fund is an investment pool that a qualified fund manager oversees. This is a trustworthy place to invest in stocks, bonds and other securities. You will be investing with a group of people who share the same investment goals.

Investing for the long term can give you more profit by investing in good timing. The stock market’s ups and downs are a normal part of investing, but a crash can be scary. Learn how to protect yourself from a stock market crash and protect your investments.

What does staking crypto mean? Staking is like putting your crypto assets on hold for a while to support a blockchain’s operations. In exchange for crypto staking, you get more crypto in return. Let’s discuss how staking works, and benefits, and explain how you can earn passive income by staking.

Money is crucially important in life. Its value depends on how it grows over time. Let’s say you have 1 lakh rupees. If you just keep it without doing anything, it becomes useless. Investing wisely in the stock market, mutual funds, bonds, or CDs can help you make more money and become wealthy.

Bitcoin is digital money that allows people to send money to each other without a central authority, using blockchain technology. The original decentralized cryptocurrency was called Bitcoin.