How to Pick Best Stocks for the Long Term investment

Long-term investment is a good option for those looking to invest their savings or income in a solid project. So, first you need to know about what the long-term investments are and how to pick the best one with your future goals. Stay with us to know about it.

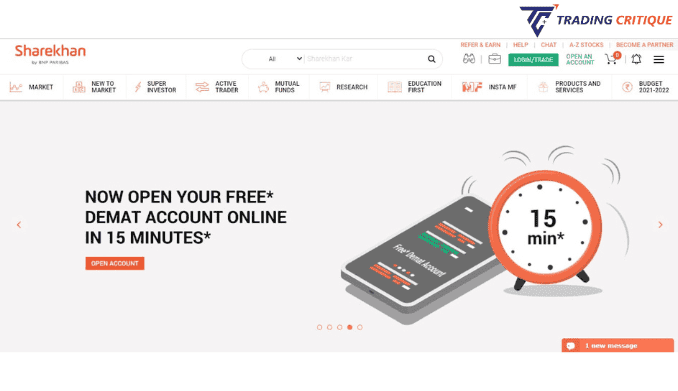

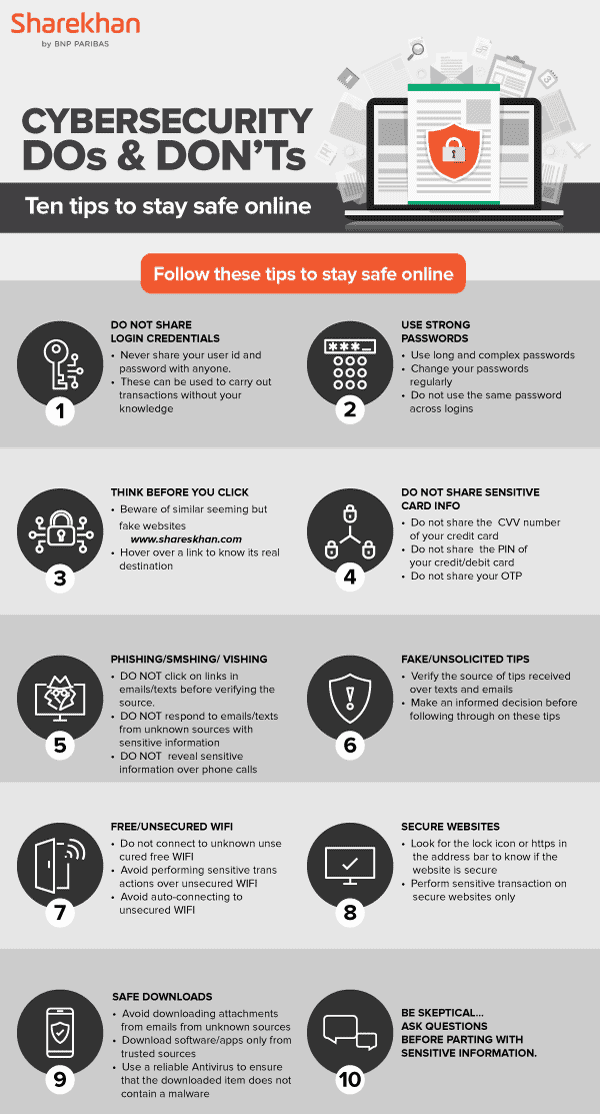

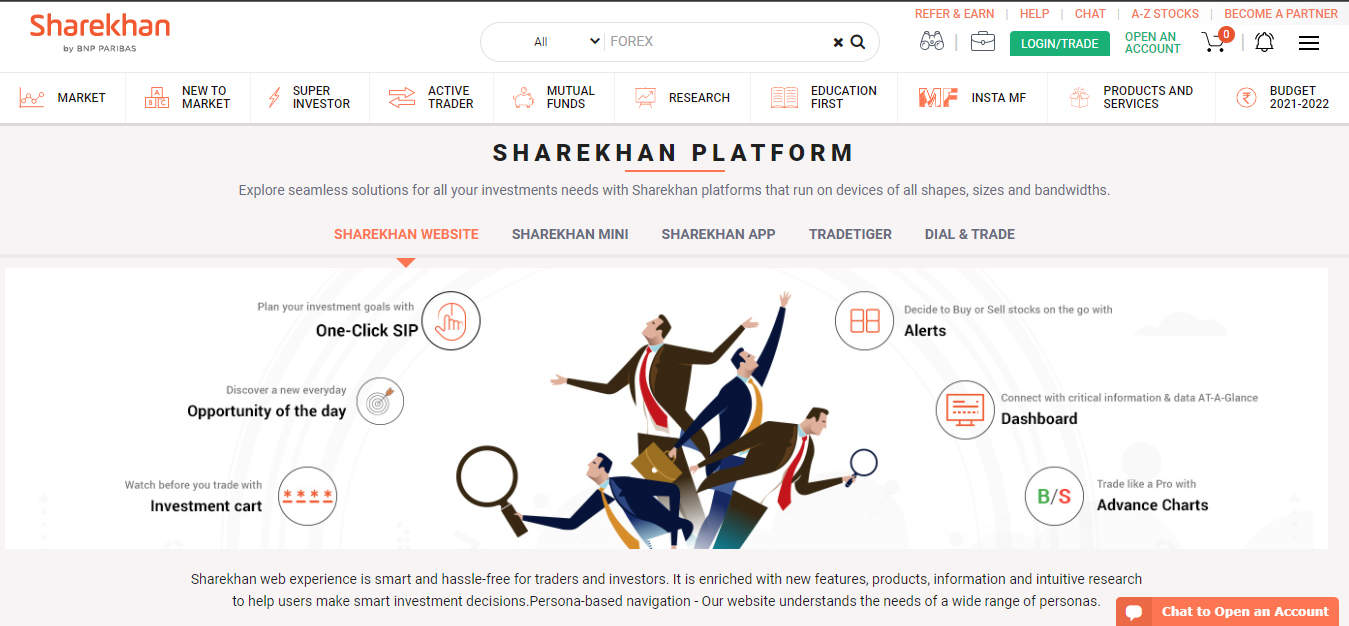

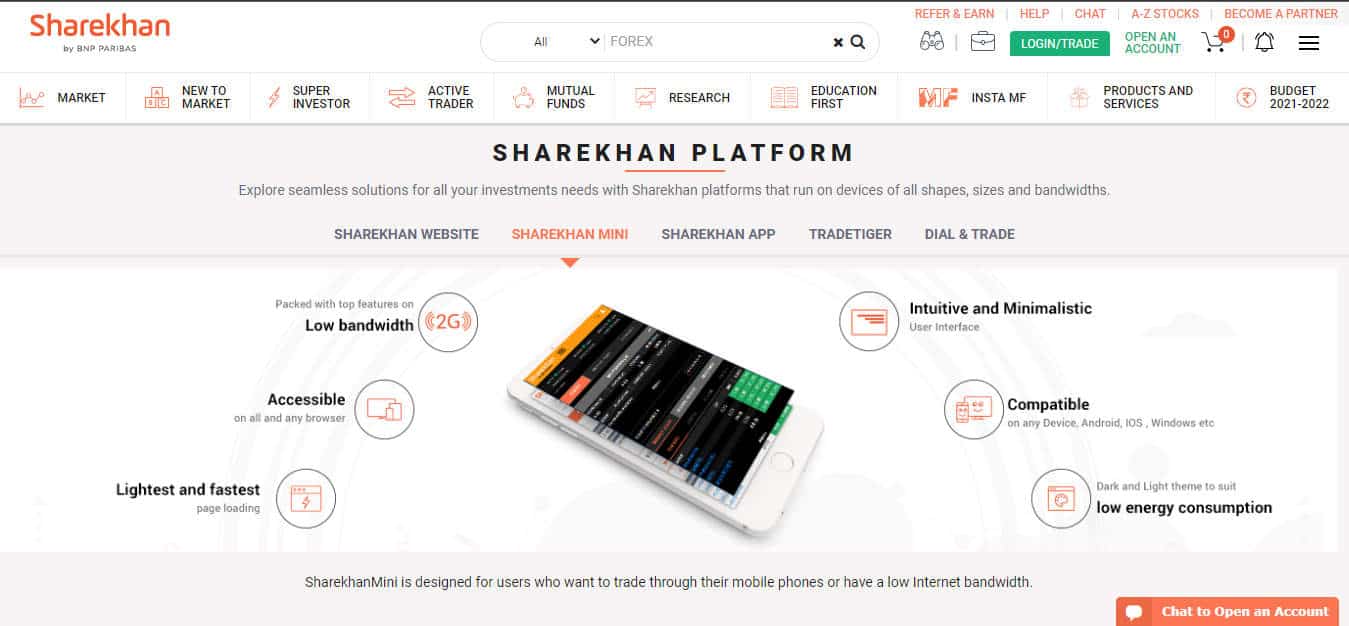

Sharekhan Highlights

Sharekhan Highlights

Award

Award

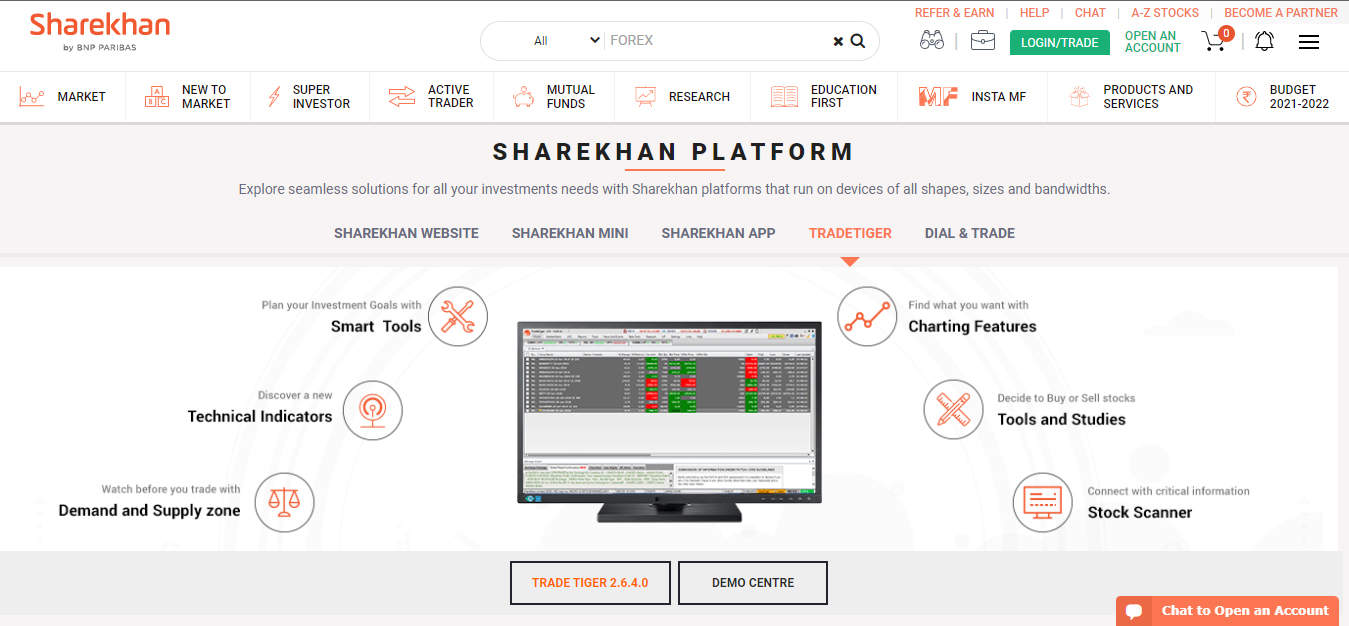

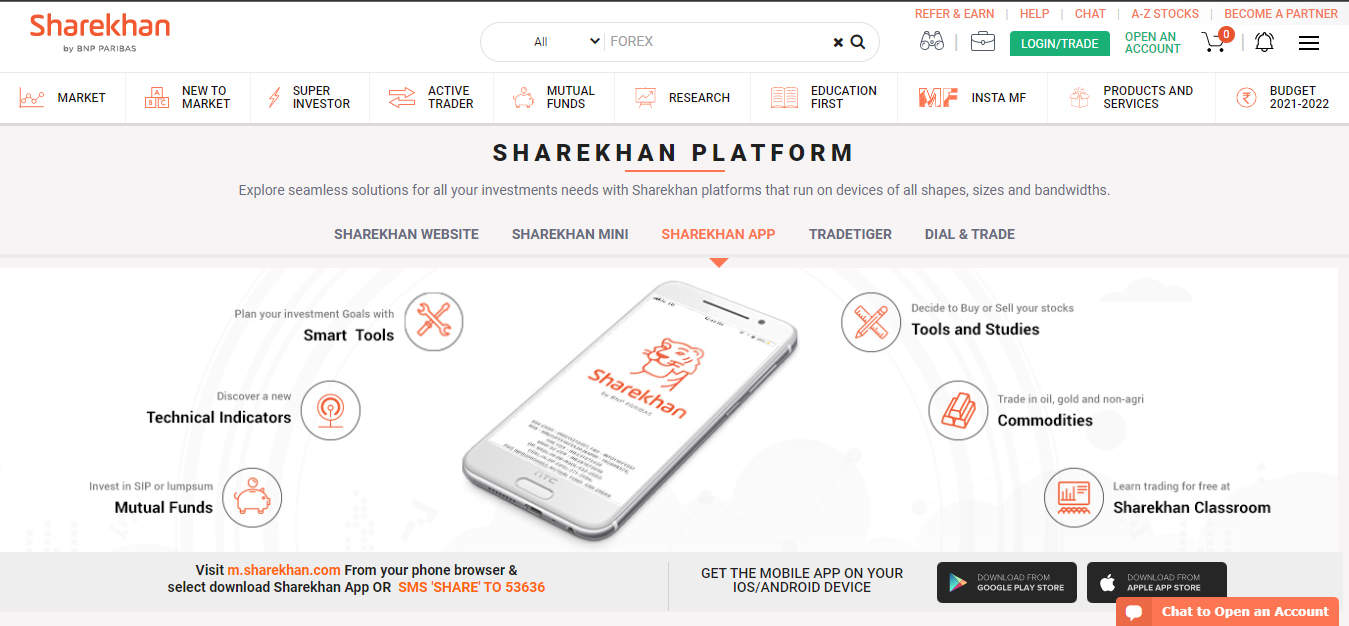

ASSETS

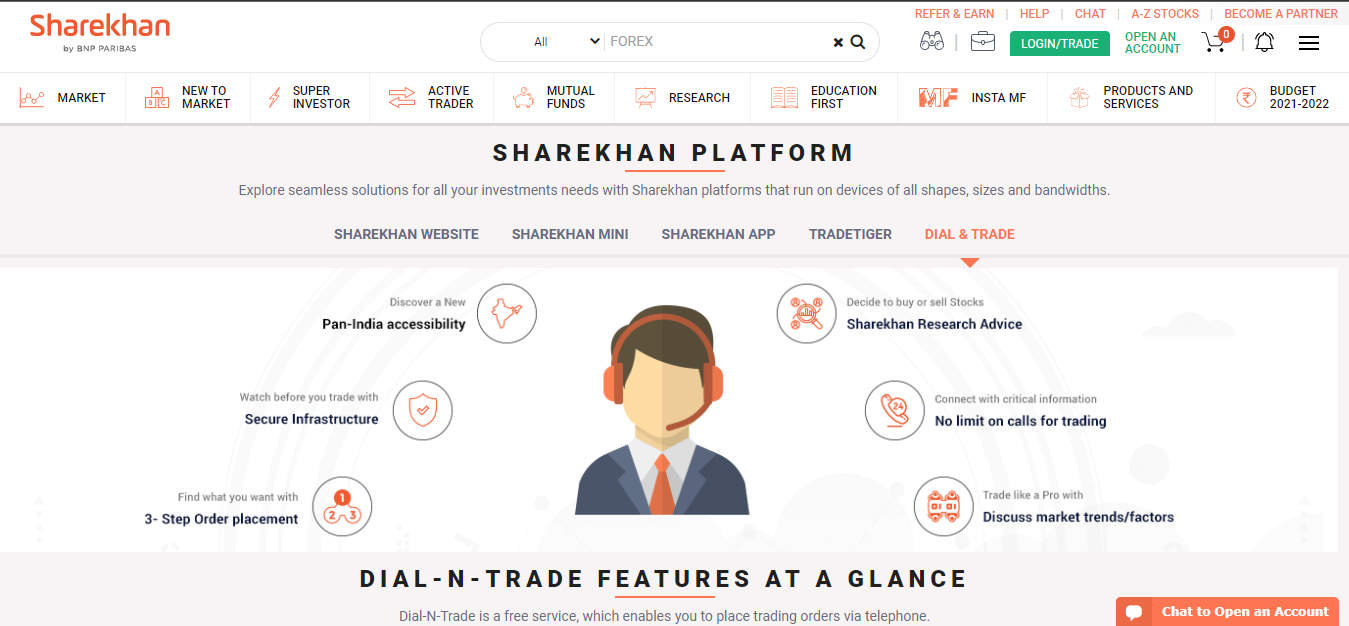

ASSETS DIAL AND TRADE TIMINGS

DIAL AND TRADE TIMINGS

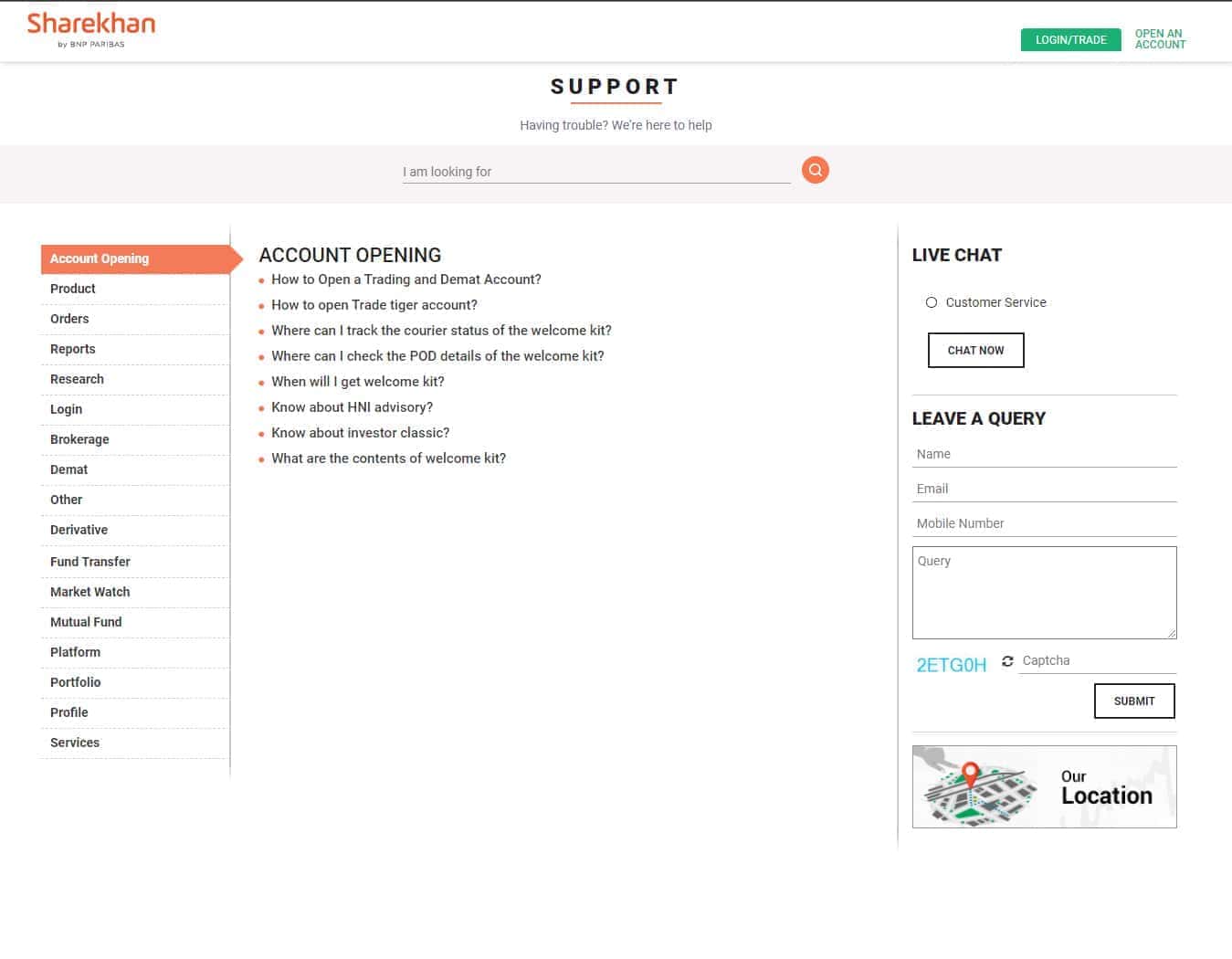

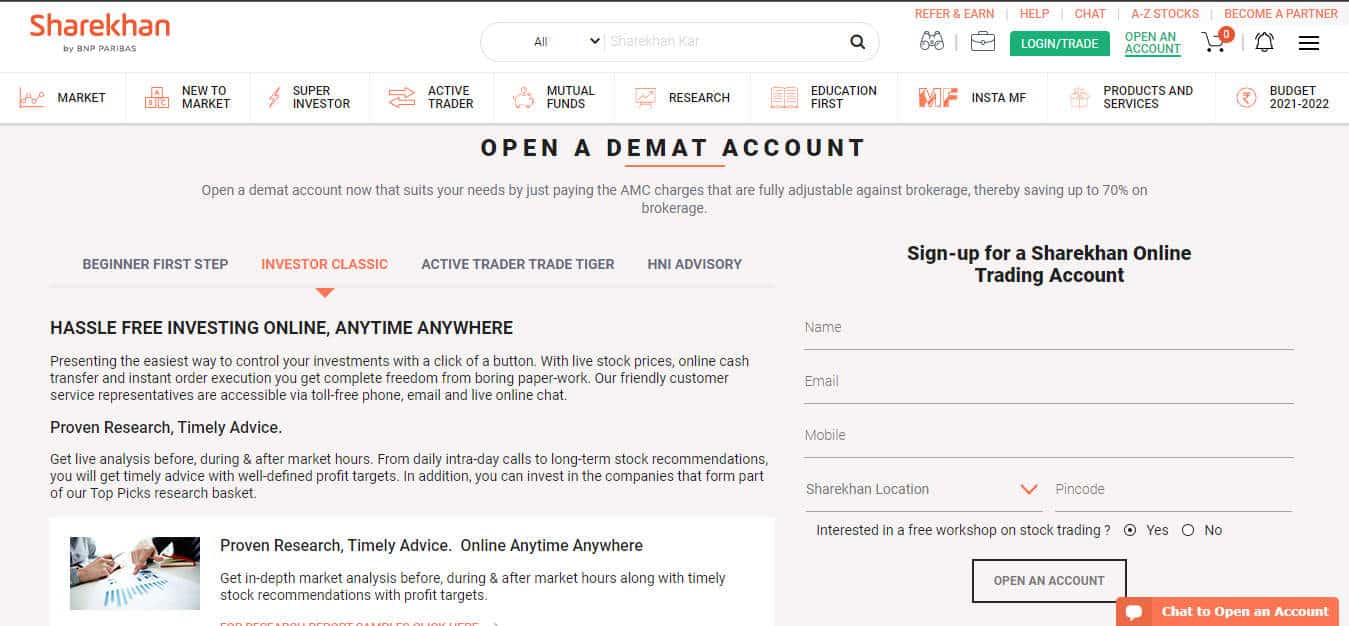

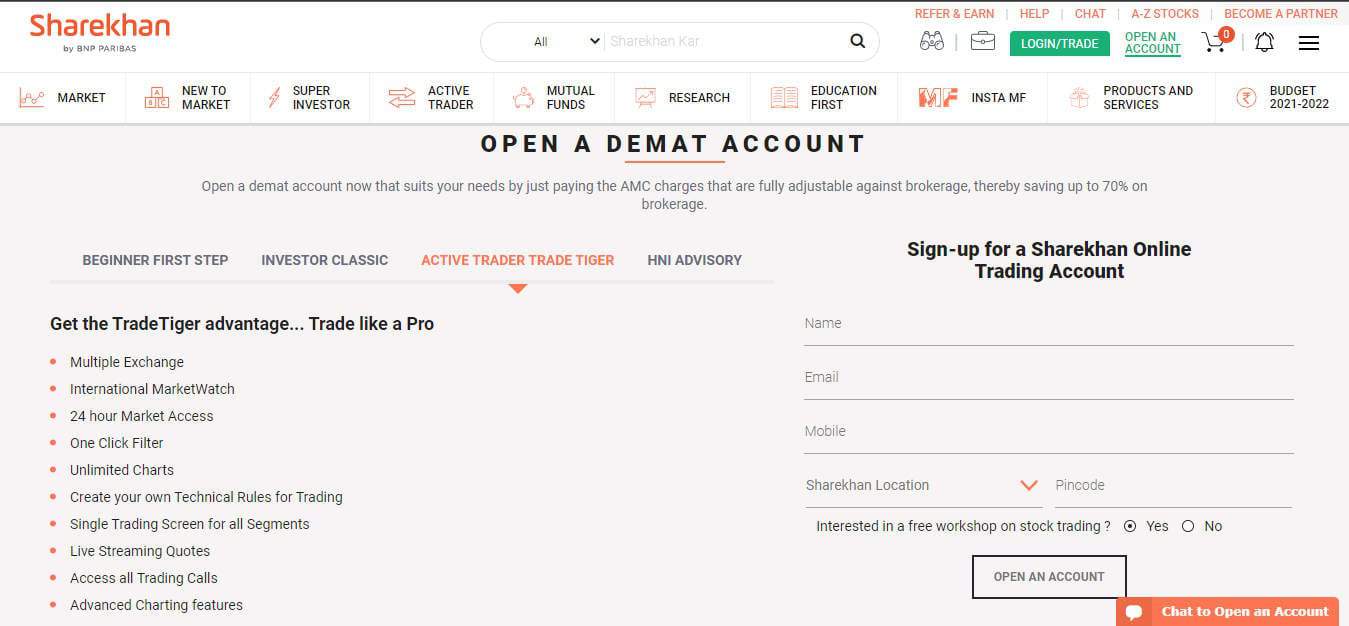

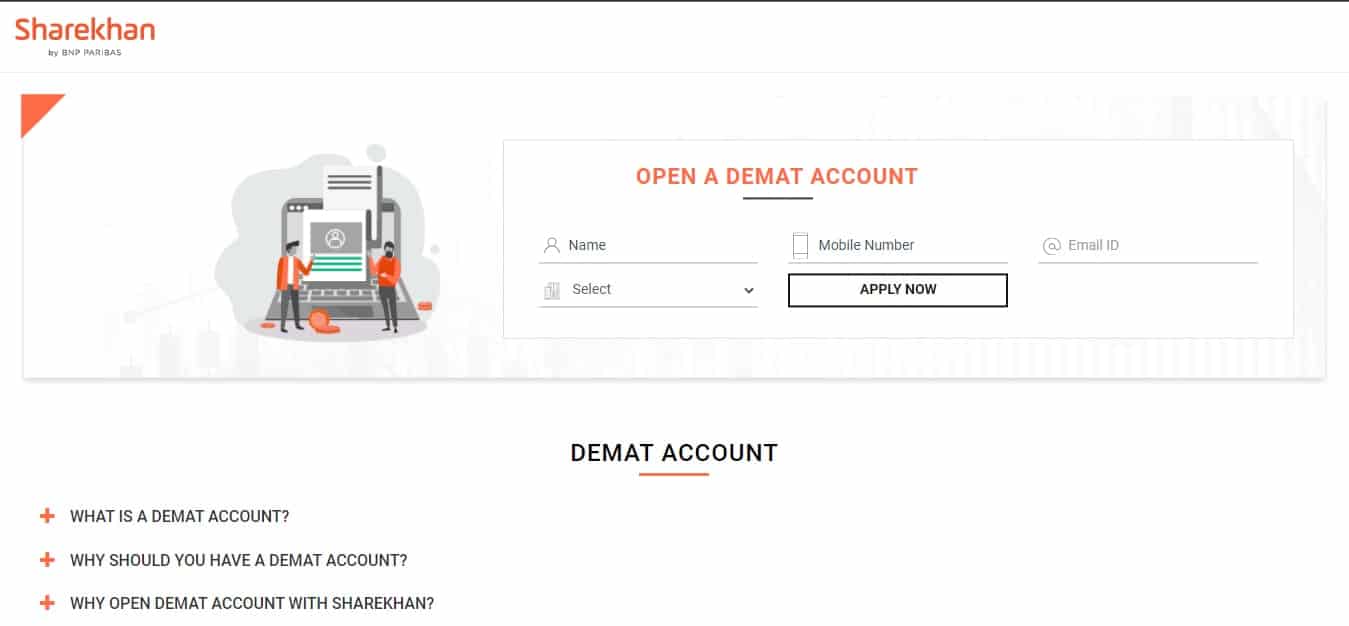

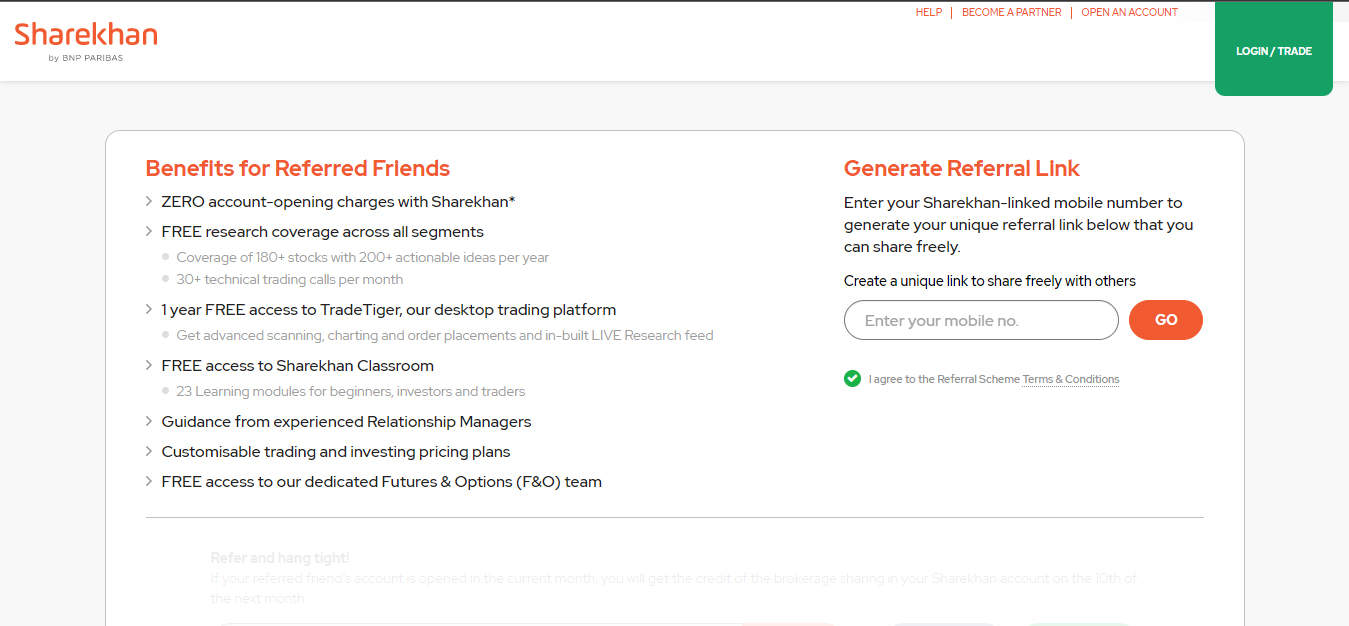

To create an account on Sharekhan, follow these steps:

To create an account on Sharekhan, follow these steps:  Brokerage Charges

Brokerage Charges Leverage

Leverage

Pros of Sharekhan

Pros of Sharekhan Cons of Sharekhan

Cons of Sharekhan

Youtube

Youtube