How to Pick Best Stocks for the Long Term investment

Long-term investment is a good option for those looking to invest their savings or income in a solid project. So, first you need to know about what the long-term investments are and how to pick the best one with your future goals. Stay with us to know about it.

Base Currencies

Base Currencies

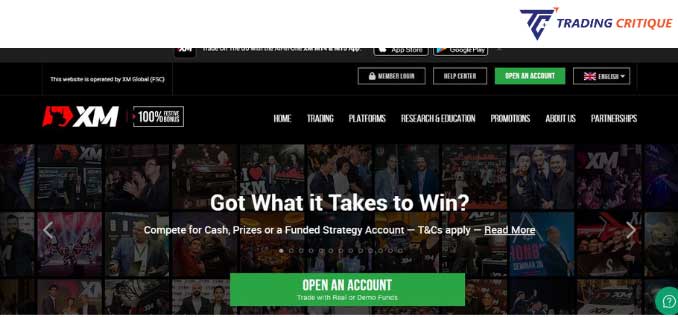

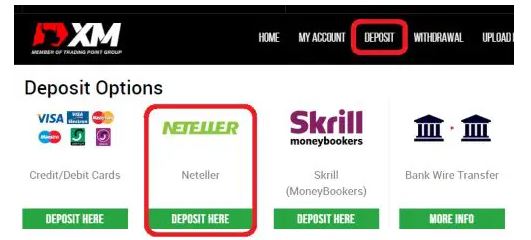

XM Deposit Methods

XM Deposit Methods Account Type

Account Type Minimum Deposit

Minimum Deposit Type of Deposit

Type of Deposit