TradingView

For traders and investors to research the financial markets, TradingView offers a social network and charting tool. For technical and fundamental analysis, it provides a wide range of tools, such as adaptable charts, indicators, and alerts. Additionally, TradingView features a vibrant social environment where users can exchange ideas, gain knowledge from one another, and connect with other traders.

Its main office is in Jersey City, New Jersey, where it was established in 2011. It is offered in more than 30 languages and has more than 50 million registered users globally. TradingView offers four subscription options, starting at $14.95 per month, in addition to a free plan. On any device, people can learn, conduct research, cooperate, talk, inquire, and practice trades.

How Does It Work

To research and trade the financial markets, TradingView is a web-based application. To help traders with their market analysis and decision-making, it provides a wide range of functions. Users may look at market trends, patterns, and price changes thanks to real-time charting features and access to more than 100 technical indicators. Traders can connect with a community, share their charts, analysis, and tactics, and participate in discussions using TradingView’s social networking features.

Users can conduct transactions straight from the TradingView interface thanks to the platform’s smooth integration with well-known trading platforms like MetaTrader 4 and 5. The trading process is streamlined by this integration, which also makes it easier for trade decisions to be quickly implemented. To meet the demands of varied users, TradingView offers a variety of membership packages. A subscription plan, which starts at $14.95 per month and offers increased functions and extra tools for sophisticated trading techniques, is an option for customers in addition to a free plan with constrained features.

Users must register for a Trading View account to begin using the service. They can look for specific financial products like stocks, commodities, currencies, or indexes after registering. To get insights into market movements, users can then generate customized charts by combining technical indicators, trendlines, and other research tools. Additionally, TradingView users have the option to share their charts with the larger TradingView community. This feature encourages communication, criticism, and cooperation between traders who have similar interests or trading approaches.

TradingView Screeners-Unleash the Power of Filtering

TradingView provides powerful screeners that let you filter stocks, cryptocurrencies, and forex pairings according to predefined criteria. This lets you find prospective trading opportunities that are relevant to your requirements.

Types of TradingView Screeners

- Technical Screeners: Use technical filters to sort equities, including moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

- Fundamental Screeners: Use fundamental filters to sort companies based on market capitalization, dividend yield, and price-to-earnings ratios (P/E).

- Heatmaps: Use colored representations to see market liquidity or volatility.

TradingView Screeners Can Help You Find Stocks That

- Depending on technical indicators, are either overbought or oversold.

- Are emerging from a trend following a period of consolidation.

- The essential requirements, such as a minimum P/E ratio or dividend yield, are met.

Benefits of Using TradingView Screeners

- Discover Hidden Opportunities: Identify possible deals that could otherwise go unnoticed.

- Time-saving Automation: Save time by automating the stock-filtering process.

- Stay Organized: Thoroughly track and keep an eye on stocks of interest.

Tips for Effective Use of TradingView Screeners

- Start Simple: To understand how screeners work, start with the most fundamental criteria, such as price, volume, and moving averages.

- Experiment and Refine: Investigate many factors to decide which ones work best for your trading strategy.

- Utilize the Watchlist: Add particular stocks to your watchlist to keep track of and assess their performance over time.

Screeners from TradingView provide a simple and effective way to find prospective trading opportunities, streamlining your trading procedure and enhancing your ability to make decisions.

TradingView Pricing

The three pricing tiers offered by TradingView are Basic, Pro, and Pro+, Premium. Although the Basic plan is free, it has few features. The three TradingView pricing tiers are contrasted in the following table by their characteristics.

| Key Benefits | Free | Pro | Pro+ | Premium | Ultimate |

|---|---|---|---|---|---|

| Subscription Plan | Free | Pro | Pro+ | Premium | Ultimate |

| Monthly Price | ₹0 | ₹1,295 | ₹2,495 | ₹4,995 | ₹39,995 |

| Look at Market Performance | |||||

| Basic Charts | |||||

| Social Network | |||||

| Charts per Tab | 1 | 2 | 4 | 8 | N/A |

| Saved Chart Layouts | 1 | 1 | 10 | Unlimited | N/A |

| Indicators per Chart | 3 | 20 | 100 | 400 | N/A |

| Active Price Alerts | 1 | 20 | 100 | 400 | N/A |

| Access to Popular Indicators | N/A | ||||

| Simulated (Paper) Trading | N/A | ||||

| Distraction-Free Trading | |||||

| Volume Profile Indicators | N/A | ||||

| Custom Time Intervals | N/A | ||||

| Multiple Watchlists | N/A | ||||

| Playback of Intraday Bars Bars | N/A | ||||

| Multi-Monitor Support | N/A | ||||

| Intraday Technical Analysis | N/A | ||||

| Intraday Exotic Charts | N/A | ||||

| Charts Based on Custom Formulas | N/A | ||||

| Chart Data Export | N/A | ||||

| Indicators On Indicators | N/A | ||||

| Highest Precision and Maximum Data | N/A | ||||

| Second-based Intervals | N/A | ||||

| Alerts that Don’t Expire | N/A | ||||

| 4x More Data on Charts (20K Bars) | N/A | ||||

| Publishing Invite-Only Indicators | N/A | ||||

| Extra Intraday Data by Four Times in Bar Replay | N/A | ||||

| Ability to Opt into Professional Data | |||||

| Unlimited Access to All Subscription Plans’ Features |

Special Features of TradingView

A well-liked charting tool for traders and investors is TradingView. It offers a variety of features, such as

Live Data

More than 100,000 financial products, including stocks, currencies, futures, and options, are covered by TradingView’s real-time data. Additionally, you can explore historical data going back up to three decades.

Strategy Testing

You can use historical data in TradingView to test your trading techniques. You may evaluate the success of your tactics and identify areas for improvement thanks to this invaluable feature.

HTML5 Charts

Whether you’re tracking a few stocks or making many dynamic charts for different marketplaces, adjust your charts to your needs. Even better, you can annotate your charts.

Technical Analysis

Use tools for analyzing various timeframes, over 50 intelligent drawing tools, over 100 pre-built indicators, and a large collection of over 100,000 community-developed indicators to help you with technical analysis.

Financial Analysis

With access to more than 100 basic characteristics, you can examine a variety of fundamental fields and ratios, financial statements, valuation research, and historical company data.

Server-Side Alerts

Set up notifications to be sent to your computer or mobile device when specific conditions go above the parameters you choose. There are 12 different alert conditions that you can select from and apply to indicators or drawing tools.

Stock Screener

Use the stock, forex, and cryptocurrency screeners on TradingView to find stocks based on particular criteria.

Customized Analysis

PineScript, a programming language that enables you to create your charts and indicators from scratch, is available to advanced users in TradingView.

Trading

You can hone your skills by practicing trading stocks, cryptocurrencies, or forex, building portfolios without using real money, or using paper trading. Additionally, TradingView has the option to simulate trading right on its charts, enabling you to try various approaches. You can also see if TradingView has a partnership with your brokerage.

Heatmaps

View sector-specific heatmaps of the stock and cryptocurrency markets, or view customized heatmaps by applying your filters.

Comprehensive Coverage

You can access more than 50 international exchanges with extended trading hours, depending on your subscription level. You also have access to more than 50 cryptocurrency markets.

Social Features

Keep in touch with other active traders, pay attention to what they do, gather ideas from them, and work with people who are involved in comparable markets.

Extensive Knowledge Base

Throughout the website, TradingView features dynamic drop-down menus and information panels that hover over new goods or concepts to provide quick facts and explanations. Additionally, a wiki page explaining the tools’ operation is available for your perusal.

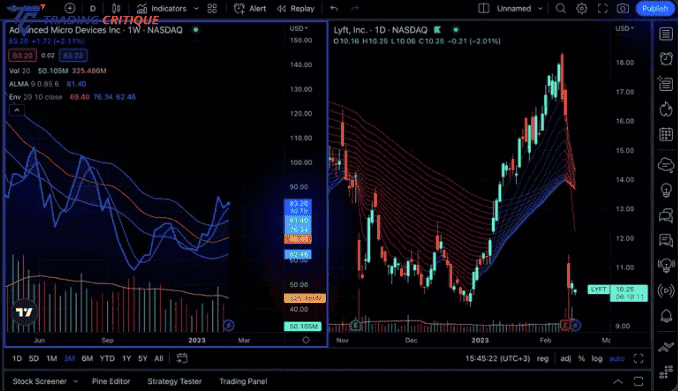

Gaining Insight into the TradingView User Interface

If you are unfamiliar with charting tools, TradingView may seem intimidating. To assist you in getting started, here is a breakdown of the user interface (UI).

Toolbar 1

All of the charting and sketching tools that you can use right in the chart area are contained in this toolbar. There are basic tools like lines and arrows as well as more complex ones like trendlines and Fibonacci retracements. Each tool has a right-click menu that shows expanded options.

Toolbar 2

This toolbar enables you to modify the chart’s appearance. You can select from a variety of chart types, including area, line, and candlestick charts. The chart’s time window can be altered, and indicators and studies can be added.

Toolbar 3

Both trading and backtesting tools are available in this toolbar. You may backtest your trading techniques using the Strategy Tester and the Trading Panel, which you can use to execute trades with your broker.

Toolbar 4

There are tools for news, social networking, and research on this toolbar. You can keep track of your favorite assets using the Watchlist, and you can view other traders’ conversations using Ideas and Streams. A personalized calendar with forthcoming business activities is also available.

Chart Area

You can view the actual chart in the chart section. Almost every aspect of the chart, including the colors, the indicators, and the comments, can be changed.

Alerts

You can set up alerts to send you notifications when specific price thresholds are reached. By doing so, you’ll be better able to monitor the market and seize chances when they present themselves.

The Ideal Choice for Advanced Traders

TradingView distinguishes itself from other trading platforms with its unmatched emphasis on charting features. It outperforms rivals by offering robust research tools and enabling access to a variety of assets, including FX and cryptocurrencies. Furthermore, TradingView provides users with access to charts for foreign stock markets, such as those in the US, Canada, the UK, Europe, China, Australia, and more. For experienced traders, TradingView is an essential and effective tool thanks to these exceptional characteristics.

Market Data in TradingView

- TradingView gives users access to a wide variety of market data from different sources.

- Depending on the membership package and certain exchanges, market data can be divided into delayed free data and real-time data.

- TradingView obtains its data from a variety of international exchanges, including those in the USA (NYSE, NASDAQ, NYSE Arca, NASDAQ GIDS, OTCUSA), India (National Stock Exchange of India), Malaysia (Bursa Malaysia Berhad), Thailand (Stock Exchange of Thailand), and others.

- On TradingView, users can receive free delayed data that enables them to view pricing data with a small-time lag.

- TradingView provides customers with real-time, tick-by-tick data to ensure they have access to the most recent market data.

- With connections to hundreds of data streams and direct access to 1,357,880 instrumentsfrom across the world, TradingView provides comprehensive coverage.

- Coverage covers key cryptocurrency exchanges (both centralized and decentralized), 40 brokerage feeds, and more than 100 stock and futures exchanges.

- To help users analyze previous price movements and create profitable trading methods, TradingView strives to provide comprehensive historical trade data for each asset.

- Financials for global companies, analyst rankings, projections, price goals, top agency news, statistics on the world economy, background information on cryptocurrencies, alternative datasets, and more are additional data points that are accessible on TradingView.

- To stay current on market news, users can select from a variety of real-time data packages provided by TradingView.

Trading on TradingView

The ability to trade directly on TradingView requires a brokerage platform relationship. Gemini, Bitstamp, Forex.com, Binance, Ally Invest, Interactive Brokers, Oanda, FXCM, and other platforms are supported for direct trading on TradingView.

Assets available for trading:

- Stocks

- ETFs

- Futures

- Indices

- Bonds

- Forex

- Cryptocurrencies

- Economic Indicators

Pros and Cons of TradingView

Pros Pros |  Cons Cons |

|---|---|

| A variety of charting tools and trading suggestions | Constraints with the free version |

| Limitations of the free version | Not every broker is supported by the API |

| Access to a vast number of global markets and assets |

In a Nutshell

- A strong platform for traders and investors, TradingView provides resources for market research and technical analysis.

- It contains powerful graphing features and an intuitive user interface.

- Users can cooperate and share ideas on the site because of its sizable and vibrant community.

- A broad collection of customizable drawing tools and technical indicators is offered by TradingView.

- It offers a variety of asset classes, making it appropriate for different kinds of traders.

- The site keeps users informed of market changes by providing real-time statistics and news feeds.

- Comprehensive and feature-rich software like TradingView improves trading and helps traders succeed in the financial markets.

Unlock the secrets of effective trading methods by exploring our Trading Critique website for comprehensive insights. Gain valuable knowledge to navigate the financial market and make intelligent investment choices.

Frequently Asked Questions

1. What is TradingView’s Social Network?

Similar to Instagram, TradingView contains social networking components that let users share and present their trading approaches. Users can browse and interact with charts, videos, commentary, and real-time chart creation by other traders on the Ideas and Streams sites. It’s crucial to remember that while these features offer chances for community connection and education, the expressed views shouldn’t be taken as financial advice. Be cautious, and keep in mind that every trader has a different style and approach.

2. What is the Level of Security Provided by TradingView?

Your money is not stored on TradingView because it is not a brokerage platform. You can use the charting tools on your selected brokerage platform to come up with trade ideas while your money stays there. Simply put, TradingView acts as an alternative trading execution method, letting you connect to your brokerage while still having your money safely stored there.

3. Is TradingView Legitimate?

Yes, TradingView is a trusted platform with 30 million users every month across 180 nations. Advanced charting tools, screeners for stocks, FX, and cryptocurrencies, heatmaps, an economic calendar, and a forum for trading ideas and scripts are all provided. It also has an economic calendar.