Best Forex trading Investigation 2021 |

|

|

|

A Smart vision Investment app |

Best forex trading innovation 2020 |

|

|

|

|

Best APAC Region broker 2018 |

ADVFN International Financial awards |

Most Innovative broker 2018 |

World Finance Markets Awards |

Most transparent broker 2017 |

|

Best Forex Service Provider |

|

Best trusted by investors |

|

|

|

|

|

|

|

Best trading platform Poland 2016 |

Finance derivative awards |

Best trading platform UK 2016 |

Global business review magazine |

Excellent trading platform |

|

|

|

|

Best partner program Europe 2015 |

|

Annual innovative products & services |

Finance derivative awards |

|

|

International business magazine |

Best broker of the year 2013 |

Global business review magazine |

|

|

Finance derivative awards |

Best forex broker 2013 Poland |

Global Financial market awards 2013 |

Best forex customer service provider

2013 |

|

Smart investor blue ribbon awards

2013 |

|

Best FX trading platform 2013 |

|

Best innovative forex platform2013 |

|

|

|

|

Best professional forex investment

platform 2013 |

|

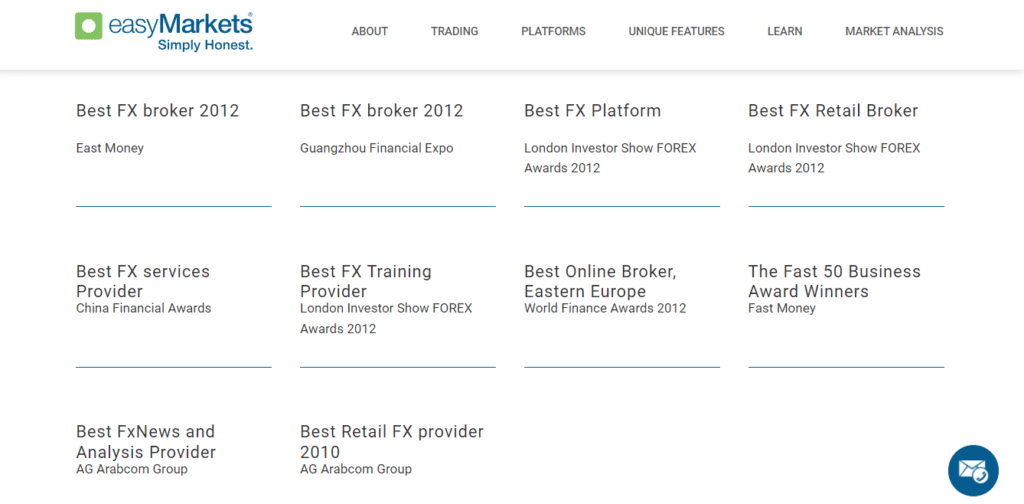

Forex company that most trusted by clients 2012 |

|

Best customer service 2012 |

London investor show Forex Awards 2012 |

|

|

|

Best forex education 2012 |

|

|

|

|

|

|

|

|

|

London investor show FOREX awards 2012 |

Best FX retail broker 2012 |

London investor show FOREX awards 2012 |

Best FX services provider 2012 |

|

Best FX training provider 2012 |

London investor show FOREX Awards 2012 |

Best online broker, Eastern Europe

2012 |

World finance awards 2012 |

The fast 50 business award winners

2012 |

|

Best FxNews and analysis provider

2012 |

|

Best retail Fx provider 2010 |

|

easyMarkets Highlights

easyMarkets Highlights

Bank Transfer

Bank Transfer

Countries that Accept easyMarkets

Countries that Accept easyMarkets Awards won by easyMarkets

Awards won by easyMarkets Awarded By

Awarded By

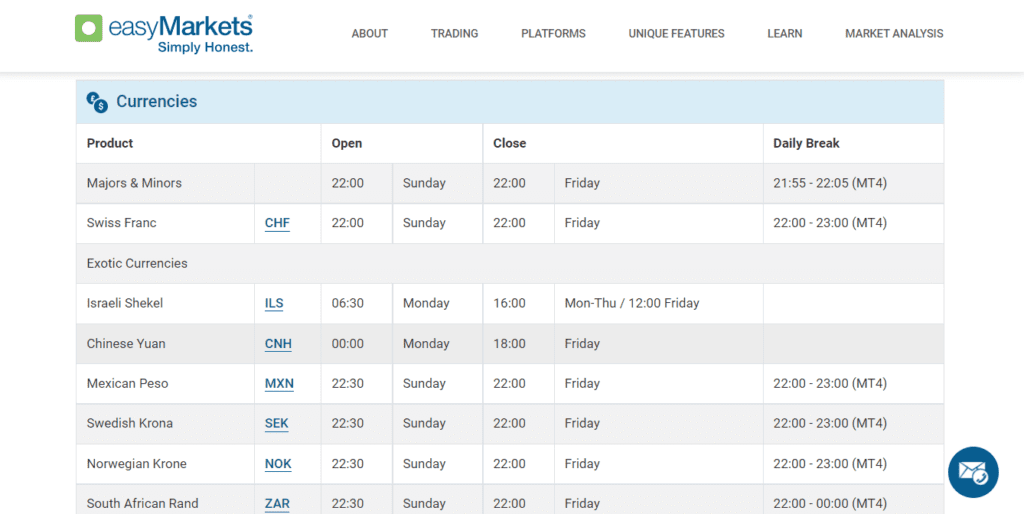

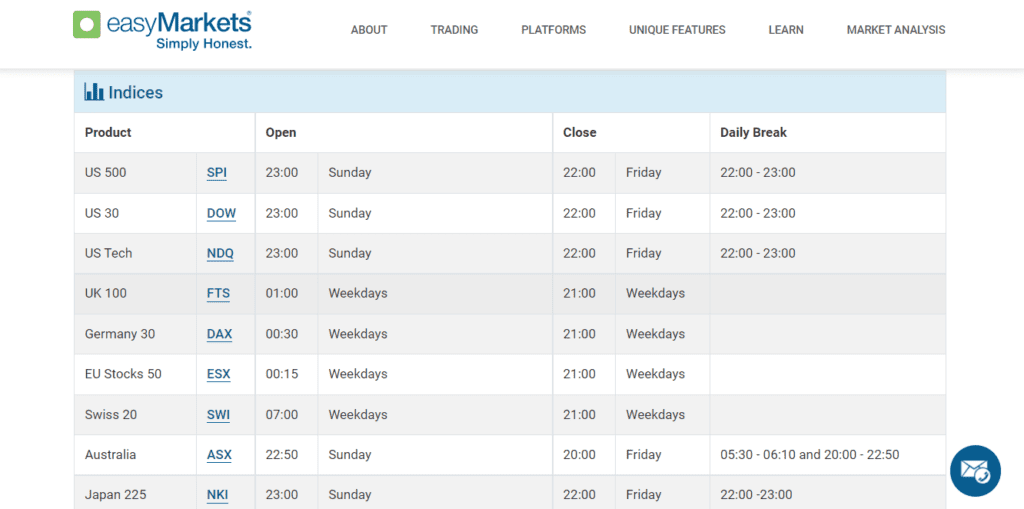

easyMarkets Forex

easyMarkets Forex