Monzo was one of the market’s first app-based Mobile Banks. They were founded in 2015 and are now the preferred choice for almost 5 million people. Therefore, in this review, our trading critique website wraps up our series on online Banking by disclosing all there is to know about Monzo.

Table 1: Monzo Overview

| Monzo Highlights | |

|---|---|

| Regulated By | The Prudential Regulation Authority (PRA) |

| The Financial Conduct Authority (FCA)(Reference No: 730427) | |

| Account Types | |

| Account Base Currencies | GBP |

| Types of Card | |

| Borrowing Features | |

| Extra Features | |

| Customer Support | 24/7 |

Monzo Bank Review – An Intro

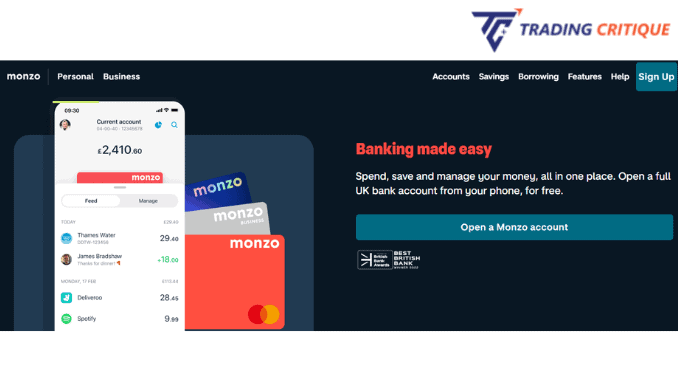

A popular digital Bank called Monzo was introduced in the UK in 2017. It aims at promoting the option to access your money through a cleverly designed smartphone app instead of visiting physical branches for young professionals.

Monzo began as a prepaid Mastercard but has since evolved into a full-fledged Bank. Monzo is much easier to use than traditional Banks and provides numerous modern Banking features.

Monzo Bank – Knowledge Bites

Monzo is a digital Bank based in London that serves the United Kingdom. Monzo provides a broad selection of Mobile Banking features that make it simple to track your spending and/or savings. You can set up a budget and closely monitor your financial objectives. With Monzo, you can quickly make payments and make purchases abroad and receive a detailed travel report once you’ve returned. They also provide Business accounts with some cool features. There are no additional costs associated with using your Monzo card anywhere in the world or in any currency. A marketplace of independent providers for savings is provided by Monzo. For your savings goals, you can pick the best provider.

Regulations & Trustability Review of Monzo

The UK Bank Monzo was fully regulated. This means that the Financial Services Compensation Scheme (FSCS) will protect your funds up to a maximum of £85,000.

The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are additional regulatory bodies that oversee the company.

Every time a payment is made, you can receive an instant notification. Online payments must be approved, and you must use a PIN, Touch ID, Face ID, or a fingerprint to protect your account.

To avoid phishing and bad password practices, Monzo does not use passwords. Instead, it generates links and emails them to you. You only need to click from this link to sign into your app. Your card can be blocked and unblocked whenever you want.

Table 2: Monzo Regulation Details

| Country | Regulation | Headquarters | Registered Office |

|---|---|---|---|

| England and Wales | the Prudential Regulation Authority (PRA) | London | Monzo Bank Limited(Registration number: 09446231)Broadwalk House, 5 Appold Street, London, England, EC2A 2AG |

| the Financial Conduct Authority (FCA)(Reference No: 730427) |

Does Monzo have a Global Presence?

Monzo can be used anywhere that accepts Mastercard. There is no requirement that you notify Monzo in advance, and there are no fees added to the exchange rate. You are simply given the exchange rate that Mastercard uses. Just keep in mind to use local currency when paying.

Review on Awards won by Monzo Bank

Monzo was selected by customers as the Best Business Banking Provider for 2022 and 2019. The Award details of Monzo Bank are given below:

Table 3 : Monzo Award Details

AWARDS AWARDS |  AWARDED BY AWARDED BY |

|---|---|

| 2022 Best Business Banking Provider | British Bank Awards |

| 2019 the Best Banking App | British Bank Awards |

Monzo Mobile App Review

You can use your smartphone or tablet to conduct all of your Banking activities on the Monzo’s Mobile app. The Monzo app does not have a desktop version. You therefore need a smartphone or tablet. The Monzo app is simple to set up, use, and maintain security for. The app is very easy to use and can be used for a variety of tasks, including adding new payments, reviewing your spending patterns, and authorizing new cards.

Review of Types of Personal Accounts available in Monzo

It only takes a few minutes to open an account with Monzo via your phone, and it also doesn’t take long to get your physical card. You can only open a Bank account at Monzo in GBP.

The Monzo Account Types are:

Monzo Current Accounts

Monzo offers a personal current account with no monthly charges, a free app, and a hot coral Mastercard as standard.

Monzo Plus Accounts

Monzo Plus has two premium packages to choose from.

The Supporter

For £4.95 a month, you can access prize draws, get Monzo swag, and take advantage of special member discounts and offers.

The Traveller

For £9 a month, you can withdraw up to £400 per month abroad, receive standard travel insurance, and access to airport lounges.

Monzo Premium Accounts

You can enhance your Monzo account with additional features using the Monzo Plus and Premium accounts. A monthly subscription of £5 / month charge applies.

The account has a minimum 6-month term and offers higher interest on deposits, phone, and travel insurance. Free five-free PayPoint deposits each month in addition to free overseas withdrawals up to £600 each.

Monzo Business Accounts

If you’re Ltd company, you can register multiple users and create and send invoices directly from the app. This is a great feature for companies that share or assign tasks related to Banking. There are currently two different Business account types offered by Monzo Business:

Monzo Business Lite

There is no monthly fee for the full-featured UK Business current account offered by Monzo Business Lite. It has a number of features, such as a Business Debit card, payment links, and free UK Bank transfers.

Monzo Business Pro

Monzo Business Pro offers a wealth of features, such as accounting integrations, virtual cards, and multi-user access for £5 /

Monzo Joint Accounts

Monzo’s joint account is highly recommended if you and your partner split expenditure and want to manage your finances jointly. This gives you both complete control over your savings accounts and expenditure. All the features for managing money available to users of personal accounts are also available for joint accounts.

Monzo 16 – 17 Accounts

Even if you’re under 18, you can still open a full UK current account with a sort code and account number. A contactless card will also be given to you for use in transactions. All of Monzo’s saving and budgeting tools are included with this account, but you cannot make purchases on illegal items that are not permitted for users under the age of 18. Overdrafts are also not permitted.

Review of Types of Cards available in Monzo

The Monzo Card Types are:

Monzo Physical Card

You can choose from hot coral, blue, or white for the Debit card that comes with all Monzo current accounts. A stylish metal card, weighing 16g, is given to premium Monzo users in place of the company’s standard plastic Debit card. The metal card has been made from a single stainless steel sheet for added rigidity, and it has a very satisfying “clink.” Precision engraving is used for card details and logos. The metal card is contactless, just like its counterpart made of plastic.

Your physical cards can be used all over the world to withdraw and make purchases. The best part is that using your card while travelling abroad is free; you only pay the Mastercard exchange rate.

Monzo Virtual Card

Plus and Premium account holders are the only ones who can access Monzo’s virtual cards. In your Monzo app, you can link virtual cards to Pots. Online purchases can be made without using the same card information because each virtual card has a unique ID, making them much safer. Your Bank accounts are safe even if a website where you’ve made purchases is breached.

Five virtual cards can be used at once with the Plus account. The best part is that you can get started right away because Monzo app users with Plus and Premium accounts can create virtual cards.

Fees & Commissions Review of Monzo

Borrowing Features Review of Monzo

Depending on the account they’ve selected, Monzo users can expect the following extra features:

Borrowing Features available in Monzo:

Monzo Flex

It can be used to pay for just about anything both online and offline. You don’t have to spend your money in just a few places. By choosing to flex purchases you made in the previous two weeks, you can also go back in time.

You can spread the cost of purchases over 6 or 12 installments at a representative 24% APR, or over 3 interest-free installments (variable).

You can modify your installment plan to spread repayment out over a longer time if you need more time using Monzo flex. As long as the overall expenditure does not exceed your limit, you may flex as many purchases as you like. You can avoid paying interest by paying a little bit extra or early.

Overdrafts

You can open a Monzo overdraft to borrow money temporarily. Monzo limits overdrafts to £1,000 and charges them at rates of 19%, 29%, or 39% EAR. Your credit score, which is accessible through the Monzo app, determines the rate. In addition, Monzo does not impose additional overdraft fees.

Loans

You can look into various loan options with flexible repayment schedules and same-day funds. If you pay off these loans early, no fees apply. A representative APR of 26.6% is available on loans from Monzo up to £3000.

Extra Features Review of Monzo

Depending on the account they’ve selected, Monzo users can expect the following extra features:

Extra Features available in Monzo:

Pots

You can manage your finances with the help of Monzo pots. Your income is divided up into different categories by the “Salary Sorter,” such as spending, saving, bills, etc. You can monitor exactly where your money is going as well as your monthly disposable income.

You can create different “savings pots” where you transfer funds to pay bills or save money. With a minimum deposit of £500, you can start Monzo’s 12-month fixed pot and receive up to 3.55% (AER, fixed) in interest. Monzo has you covered if you prefer quick access to your savings. You can get your money the following working day if you use their easy access savings account.

Travelling with Monzo

You can spend money overseas in any currency without being charged. Simply pay the exchange rate given by Mastercard. Additionally, Monzo offers travel reports that detail your travel expenses. You can also purchase worldwide family trip cancellation insurance for up to £5,000 on premium accounts.

Bill Splitting

This function keeps tabs on who is responsible for what when you go out to eat, take a day trip, or split household expenses. Pay bills as they come in or at the end of the night, and split the bill however you like.

Bonus Review of Monzo

Monzo has launched their referral program, which allows you to earn £5 for signing up and an additional £5 for each friend you refer. You’ll get a £5 bonus once your account has been opened and a card payment has been made within 30 days.

Education and Research Review of Monzo

In the Blog section, you can find the most recent Monzo team news, tips, guides, and stories. Monzo has put together a list of outside resources that you might find useful in numerous Blogs.

Advantages & Disadvantages of Monzo

Monzo has both advantages and disadvantages which are listed in Table 4.

Table 4 : Pros and Cons of the Monzo Website

Here is the table format for the “Pros of Monzo” and “Cons of Monzo”:

Pros of Monzo Pros of Monzo |  Cons of Monzo Cons of Monzo |

|---|---|

| Your savings can earn interest. | The desktop app for Monzo does not exist. |

| Monzo provides a simple and user-friendly app with a range of tools. | There is no credit card offered by Monzo. |

| You are able to create joint accounts with Monzo. | Every time you make a cash deposit into your Monzo account, Monzo charges you £1. |

| The Financial Services Compensation Scheme (FSCS) insures deposits up to a maximum of £85,000 per account. | |

| The mobile app provides 24-hour customer service. | |

| Monzo is a member of the Financial Conduct Authority (FCA). |

Customer Support Review of Monzo

The Monzo support team can be reached over the phone or through the in-app live chat feature. The chat is accessible around-the-clock for urgent issues. The Monzo team is available for chat from 7 am to 8 pm if you have any other questions.

An online help center is available from Monzo. You can find a variety of resources here, such as instructions on how to manage your account, make Mobile payments, set up pots and budgets, get an overdraft, and much more.

Additionally, Monzo encourages users to voice their concerns and pose questions in a lively online forum.

Table 5 : Customer Support Service Details of Monzo

| Social Media Pages of Monzo | |

|---|---|

| Phone | +448008021281 (UK)+442038720620 (Abroad) |

| help@Monzo.com | |

| https://twitter.com/Monzo | |

| Youtube | https://www.youtube.com/MonzoBank |

| https://www.instagram.com/Monzo/ | |

| https://www.linkedin.com/company/Monzo-Bank | |

| https://www.facebook.com/MonzoBank | |

In a Nutshell – Monzo Review

Looking to succeed in trading? Trading critique website is here to help. We provide a wealth of resources, including trading advice, broker reviews, financial news, and blogs. We value transparency and encourage you to share your thoughts if you open a Monzo account. Our website is designed to help traders of all levels make informed decisions and stay up-to-date with the latest developments in finance.

Frequently Asked Questions – Monzo

1. Monzo-is it a Bank?

Yes, the Bank Monzo is an app-based.

2. Is there a Credit Card for Monzo?

No, there is a Debit card for Monzo.

3. Is Monzo Completely Free?

It is completely free to open a Monzo account and use it on a daily basis.

4. Is Monzo a Contactless Payment System?

Yes! Monzo is contactless and allows you to make contactless payments of up to £100.

5. What Exactly is Monzo.me?

Monzo.me is a unique link that allows you to easily pay people with Monzo or request money from your friends.